Washoe NV Tax Collector: A Comprehensive Guide To Understanding Tax Collection In Washoe County

Taxes play a vital role in maintaining public services and infrastructure in any community. In Washoe County, Nevada, the Washoe NV Tax Collector is responsible for managing and overseeing tax-related activities. If you're a resident or business owner in the area, understanding the role of the tax collector is essential for financial planning and compliance with local regulations.

The Washoe NV Tax Collector is not just an administrative office; it serves as a crucial link between the government and taxpayers. The office ensures that property taxes are collected efficiently and that funds are allocated appropriately for public services. By familiarizing yourself with the tax collection process, you can better manage your financial obligations and avoid potential penalties.

In this article, we will delve into the responsibilities of the Washoe NV Tax Collector, explore the tax collection process, and provide valuable insights to help you navigate the system. Whether you're a first-time homeowner or a seasoned business professional, this guide will equip you with the knowledge you need to stay informed and compliant.

- Family Care Eye Center

- Sexiest Just For Laughs Gags

- The Silver And Gold Is Mine

- Smoking Jerky On A Traeger

- The Ridge Restaurant The Hotel Belvidere Hawley Photos

Table of Contents

- Introduction to Washoe NV Tax Collector

- Responsibilities of the Washoe NV Tax Collector

- Understanding the Tax Collection Process

- Property Taxes in Washoe County

- Payment Options for Taxpayers

- Handling Delinquent Taxes

- Useful Resources for Taxpayers

- Frequently Asked Questions

- Key Statistics on Tax Collection

- Conclusion and Call to Action

Introduction to Washoe NV Tax Collector

The Washoe NV Tax Collector is a government office tasked with the administration and collection of property taxes in Washoe County, Nevada. This office plays a pivotal role in ensuring that local governments have the necessary funds to maintain public services such as schools, roads, and emergency services. The tax collector works closely with other government agencies to ensure that all property taxes are assessed and collected accurately.

Understanding the role of the Washoe NV Tax Collector is essential for anyone who owns property in the county. Whether you're a homeowner or a business owner, staying informed about tax deadlines, payment options, and potential penalties can help you avoid unnecessary complications.

Responsibilities of the Washoe NV Tax Collector

Primary Duties

The Washoe NV Tax Collector has several key responsibilities, including:

- Food At Jordan Landing

- Alexs Brother In Lufe Is Strange

- Miranda Lambert Country Music Awards

- Where Is The Legacy Museum

- Rush Hour Go Karts Garner

- Managing property tax assessments and ensuring they are accurate.

- Collecting property taxes from residents and businesses.

- Processing tax payments and issuing receipts.

- Handling delinquent tax accounts and working with taxpayers to resolve issues.

These responsibilities are crucial for maintaining the financial health of the county and ensuring that public services remain adequately funded.

Collaboration with Other Agencies

The Washoe NV Tax Collector collaborates with various agencies, such as the Washoe County Assessor's Office and the Treasurer's Office, to ensure that all aspects of tax collection are handled efficiently. This collaboration ensures that taxpayers receive accurate information and that all tax-related processes are streamlined.

Understanding the Tax Collection Process

The tax collection process in Washoe County involves several steps, starting with property assessments and ending with the collection of taxes. Below is a detailed breakdown of the process:

- Property Assessment: The Assessor's Office evaluates the value of all properties in the county.

- Tax Rate Determination: The county determines the tax rate based on budgetary needs and property values.

- Tax Billing: The Tax Collector sends out tax bills to property owners, detailing the amount owed.

- Tax Payment: Property owners pay their taxes by the designated deadline.

Each step is carefully managed to ensure that the process is transparent and fair for all taxpayers.

Property Taxes in Washoe County

How Property Taxes Are Calculated

Property taxes in Washoe County are calculated based on the assessed value of the property and the tax rate set by the county. The formula for calculating property taxes is straightforward:

Property Tax = Assessed Value x Tax Rate

For example, if a property has an assessed value of $200,000 and the tax rate is 1%, the property tax would be $2,000.

Factors Affecting Property Tax Rates

Several factors can influence property tax rates in Washoe County, including:

- Local government budgets.

- Changes in property values.

- Economic conditions in the region.

These factors are carefully considered when determining the tax rate to ensure that it remains fair and equitable for all taxpayers.

Payment Options for Taxpayers

The Washoe NV Tax Collector offers several payment options to make it easier for taxpayers to fulfill their obligations. These options include:

- Online Payments: Taxpayers can pay their taxes online through the official Washoe County website.

- In-Person Payments: Payments can be made in person at the Tax Collector's office during business hours.

- Mail Payments: Taxpayers can send their payments via mail, ensuring they include the payment stub for proper processing.

Each option provides flexibility and convenience, allowing taxpayers to choose the method that best suits their needs.

Handling Delinquent Taxes

Consequences of Delinquent Taxes

Failing to pay property taxes on time can result in several consequences, including:

- Penalties and interest charges.

- Liens placed on the property.

- Potential foreclosure proceedings.

It's essential to address delinquent taxes promptly to avoid these negative outcomes.

Options for Resolving Delinquent Taxes

The Washoe NV Tax Collector offers various options for resolving delinquent taxes, such as payment plans and settlements. Taxpayers experiencing financial difficulties should contact the office to explore these options and find a solution that works for them.

Useful Resources for Taxpayers

The Washoe NV Tax Collector provides several resources to assist taxpayers, including:

- Official Website: Offers information on tax rates, payment options, and deadlines.

- Contact Information: Provides phone numbers and addresses for the Tax Collector's office.

- FAQ Section: Answers common questions about property taxes and the collection process.

These resources are invaluable for staying informed and ensuring compliance with tax regulations.

Frequently Asked Questions

What Happens If I Miss a Tax Payment Deadline?

If you miss a tax payment deadline, you may incur penalties and interest charges. It's important to contact the Washoe NV Tax Collector as soon as possible to discuss your options and avoid further consequences.

Can I Appeal My Property Tax Assessment?

Yes, you can appeal your property tax assessment if you believe it is inaccurate. The Washoe County Assessor's Office provides information on the appeals process and deadlines.

Key Statistics on Tax Collection

According to data from the Washoe NV Tax Collector, the county collected approximately $450 million in property taxes in the last fiscal year. This revenue is crucial for funding public services and infrastructure projects in the area. The office also reports a delinquency rate of less than 5%, highlighting the efficiency of the tax collection process.

For more detailed statistics, you can refer to the official Washoe County website or contact the Tax Collector's office directly.

Conclusion and Call to Action

In conclusion, the Washoe NV Tax Collector plays a vital role in managing property taxes in Washoe County. By understanding the responsibilities of the office, the tax collection process, and available resources, taxpayers can better manage their financial obligations and avoid potential complications.

We encourage you to take action by reviewing your tax obligations, exploring payment options, and utilizing the resources provided by the Washoe NV Tax Collector. If you have any questions or need further assistance, don't hesitate to reach out to the office or consult the official website for more information.

Feel free to leave a comment or share this article with others who may find it helpful. Together, we can ensure that all taxpayers in Washoe County remain informed and compliant with local regulations.

- Why Is Cvs Charging Me 5 A Month

- Rush Hour Go Karts Garner

- Leaf And Bud Photos

- Universal Studios Hollywood Whoville

- Shoe Stores At University Park Mall

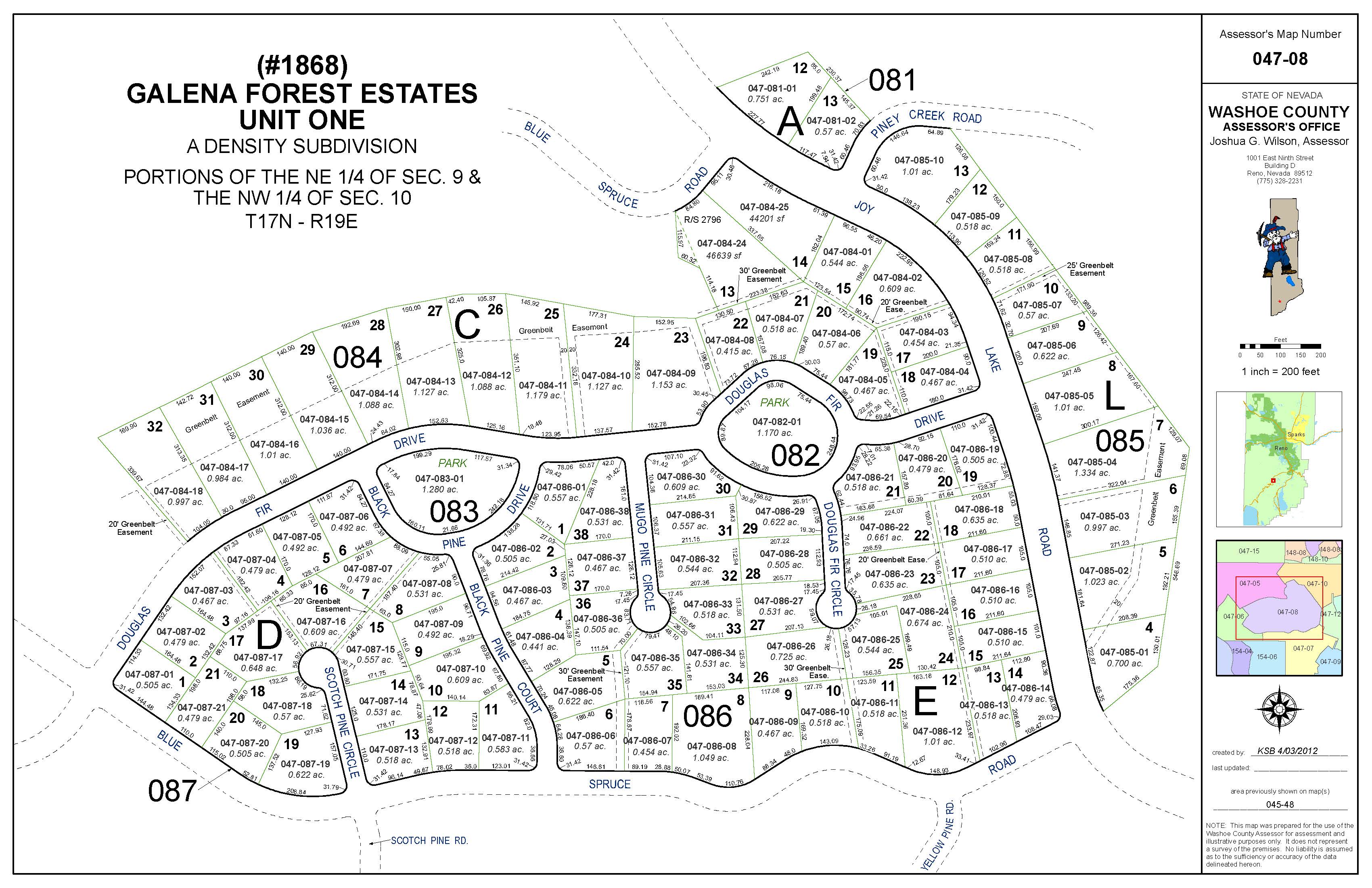

Washoe County Assessor's Office Mapping Division Washoe County, NV

Time to play my favourite game again! Same person, same shirt, one year

Washoe County Sheriff’s Office Leads Investigation into Officer