How To Get Tax Advances With TurboTax: A Comprehensive Guide

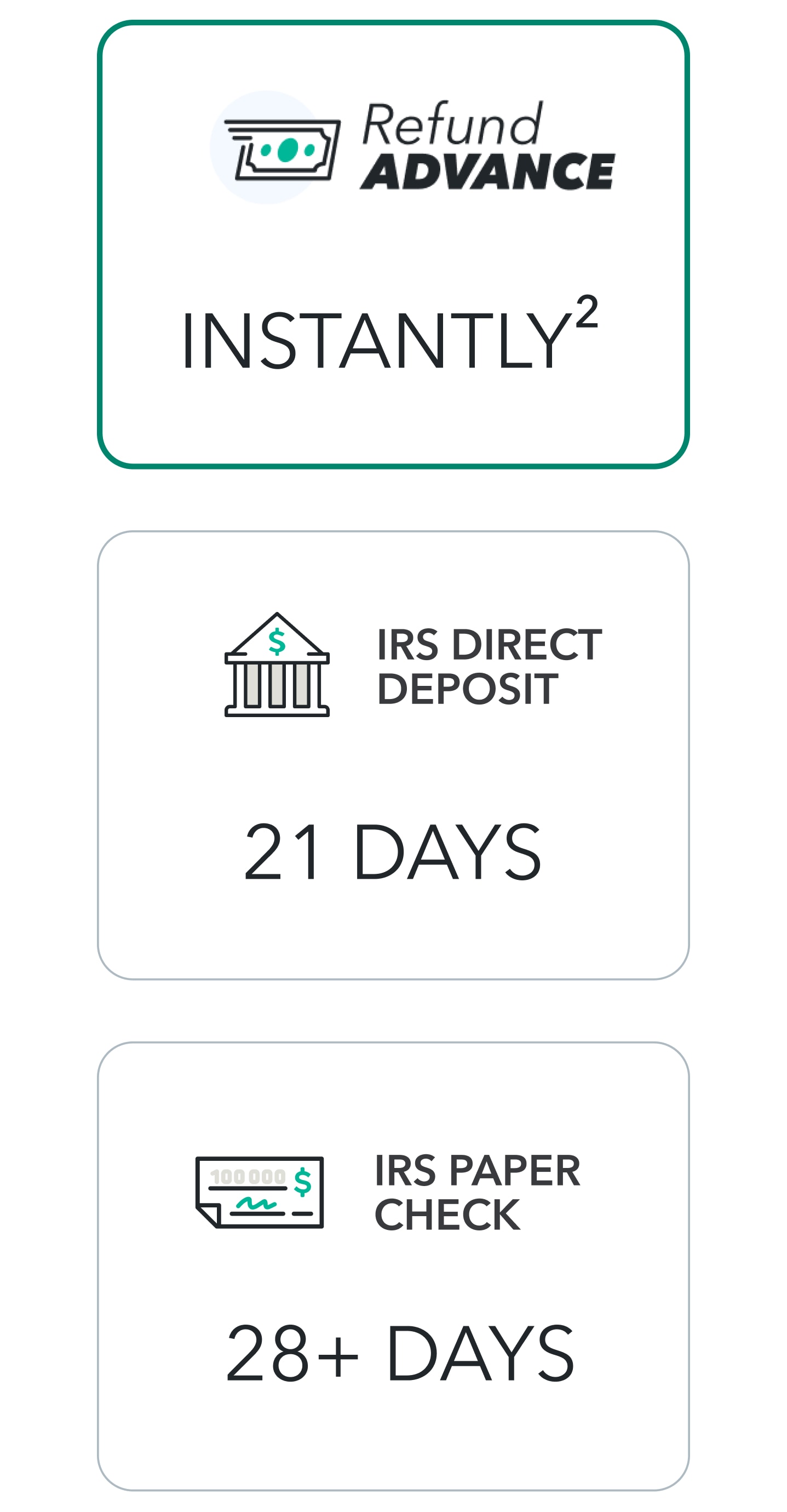

Tax season can be stressful, but getting a tax advance through TurboTax can help ease financial burdens. TurboTax, one of the most trusted names in tax preparation software, offers a variety of services to make the tax filing process easier. One of these services is the TurboTax tax advance, which allows taxpayers to access a portion of their refund before the IRS processes it. This option is particularly useful for individuals who need immediate financial support.

Understanding how to get a tax advance with TurboTax is crucial for anyone looking to take advantage of this service. In this guide, we will walk you through the process step by step, ensuring you have all the information you need to make an informed decision. Whether you're a first-time user or a seasoned TurboTax customer, this article will provide valuable insights into tax advances and their benefits.

Before diving into the details, it's important to note that TurboTax tax advances come with certain terms and conditions. Understanding these terms will help you avoid unexpected fees and ensure that you're making the best financial decision for your situation. Let's explore how you can get a tax advance with TurboTax and what you need to know.

- Sexiest Just For Laughs Gags

- Doubletree Hotel International Drive Orlando Fl

- Avli Little Greek Tavern

- Houses For Rent Bremerton

- What Does Aces Tattoo Stand For

What is a TurboTax Tax Advance?

A TurboTax tax advance is a short-term loan provided by a third-party lender, not TurboTax itself. This advance allows you to access a portion of your expected tax refund before the IRS processes and issues it. The amount you can borrow typically ranges from $300 to $1,000, depending on your refund estimate and lender policies.

This service is designed to help taxpayers who need immediate cash flow during tax season. Unlike traditional loans, TurboTax tax advances are repaid directly from your tax refund, making the repayment process seamless. However, it's important to carefully review the terms and conditions, as there may be fees associated with this service.

Why Choose TurboTax for Tax Advances?

Trusted Brand with Expertise

TurboTax is renowned for its user-friendly interface and comprehensive tax preparation tools. As a leader in the tax software industry, TurboTax offers a range of services tailored to meet the needs of various taxpayers. When it comes to tax advances, TurboTax partners with reputable lenders to ensure a secure and efficient process.

- Woodinville Department Of Licensing

- Animal Hospital In Crystal Lake Il

- Amphitheater Tampa Florida State Fairgrounds

- The Red Grape In Sonoma

- Westland Shopping Center Photos

Convenience and Accessibility

One of the biggest advantages of using TurboTax for tax advances is the convenience it offers. The entire process can be completed online, saving you time and effort. TurboTax integrates seamlessly with your tax preparation workflow, allowing you to apply for a tax advance while filing your return.

Transparent Fees and Terms

TurboTax is committed to transparency, ensuring that users are fully informed about the fees and terms associated with tax advances. Before proceeding with the application, you will have the opportunity to review all relevant details, including interest rates and repayment terms. This transparency helps you make an informed decision about whether a tax advance is right for you.

Steps to Get a Tax Advance with TurboTax

Step 1: Prepare Your Tax Documents

Before applying for a tax advance, gather all necessary tax documents, including your W-2 forms, 1099s, and any other relevant financial statements. Having these documents ready will streamline the tax preparation process and ensure accuracy in your refund estimate.

Step 2: Start Your TurboTax Return

Log in to your TurboTax account and begin preparing your tax return. TurboTax will guide you through the process, asking questions to determine your eligibility for a tax advance. Make sure to answer all questions accurately to receive an accurate refund estimate.

Step 3: Check Eligibility

During the tax preparation process, TurboTax will inform you if you're eligible for a tax advance. Eligibility is based on factors such as your expected refund amount, credit history, and lender requirements. If eligible, you will be presented with the option to apply for a tax advance.

Step 4: Apply for the Tax Advance

If you decide to proceed, follow the prompts to apply for the tax advance. You will be asked to provide additional information, such as your bank account details, to facilitate the transfer of funds. Once your application is submitted, the lender will review it and issue a decision.

Step 5: Receive Your Funds

If approved, the funds will be deposited directly into your bank account within a few business days. It's important to note that the exact timing may vary depending on your lender and bank processing times. Once your tax refund is issued by the IRS, the advance amount will be deducted, and the remaining balance will be deposited into your account.

Understanding the Costs and Fees

While TurboTax tax advances offer a convenient way to access your refund early, it's essential to understand the associated costs and fees. These may include:

- Loan Origination Fee: A one-time fee charged by the lender for processing the tax advance.

- Interest Charges: Depending on the lender, you may be required to pay interest on the borrowed amount.

- Service Fees: Some lenders may charge additional fees for using their services.

It's crucial to carefully review all fees and terms before proceeding with the application. TurboTax provides detailed information about these costs during the application process, ensuring transparency and helping you make an informed decision.

Eligibility Requirements for TurboTax Tax Advances

Refund Estimate

To qualify for a TurboTax tax advance, you must have a positive refund estimate. TurboTax calculates this estimate based on the information you provide during the tax preparation process. A higher refund estimate increases your chances of approval for a larger advance amount.

Credit History

While credit history is not the primary factor in determining eligibility, it may still play a role. Lenders consider your credit score and history to assess risk and determine the terms of the advance. However, TurboTax tax advances are generally more accessible than traditional loans, as they are backed by your expected refund.

Bank Account

You must have an active bank account to receive the tax advance funds. The lender will deposit the funds directly into your account, and the repayment will be deducted from your tax refund once it's issued by the IRS.

Advantages of TurboTax Tax Advances

TurboTax tax advances offer several benefits, including:

- Quick Access to Funds: Receive your advance within a few business days, providing immediate financial relief.

- Seamless Integration: The application process is integrated into TurboTax, making it easy to apply while preparing your tax return.

- Transparent Terms: TurboTax ensures that all fees and terms are clearly outlined, allowing you to make an informed decision.

These advantages make TurboTax tax advances a popular choice for taxpayers who need quick access to their refund.

Potential Drawbacks to Consider

Fees and Interest

While TurboTax tax advances provide quick access to funds, they come with fees and interest charges that can add up. It's important to weigh these costs against the benefits to determine if a tax advance is the right choice for your financial situation.

Repayment Dependence

The repayment of a TurboTax tax advance is dependent on the IRS issuing your refund. If there are delays in processing or issues with your return, it may take longer to repay the advance, potentially leading to additional fees.

Tips for Maximizing Your TurboTax Tax Advance

To make the most of your TurboTax tax advance, consider the following tips:

- Apply Early: The earlier you apply, the sooner you can access your funds.

- Review Terms Carefully: Ensure you fully understand all fees and terms before proceeding.

- Plan Your Expenses: Use the advance wisely by planning your expenses and prioritizing essential needs.

By following these tips, you can maximize the benefits of your TurboTax tax advance while minimizing potential drawbacks.

Alternatives to TurboTax Tax Advances

If a TurboTax tax advance isn't the right option for you, there are alternative ways to access funds during tax season:

- Traditional Loans: Consider personal loans or lines of credit from banks or credit unions.

- Credit Cards: Use credit cards for short-term financing, but be cautious of interest rates.

- Refund Anticipation Loans: Similar to tax advances, these loans are offered by some tax preparation services.

It's important to explore all options and choose the one that best fits your financial needs and circumstances.

Conclusion

In conclusion, TurboTax tax advances offer a convenient way to access a portion of your expected tax refund before the IRS processes it. By following the steps outlined in this guide, you can successfully apply for a tax advance and receive your funds quickly. However, it's crucial to carefully review all fees and terms to ensure that a tax advance is the right choice for your financial situation.

We encourage you to share your thoughts and experiences in the comments below. If you found this article helpful, please consider sharing it with others who may benefit from the information. For more insights into tax preparation and financial planning, explore our other articles on the website.

Table of Contents

- What is a TurboTax Tax Advance?

- Why Choose TurboTax for Tax Advances?

- Steps to Get a Tax Advance with TurboTax

- Understanding the Costs and Fees

- Eligibility Requirements for TurboTax Tax Advances

- Advantages of TurboTax Tax Advances

- Potential Drawbacks to Consider

- Tips for Maximizing Your TurboTax Tax Advance

- Alternatives to TurboTax Tax Advances

- Conclusion

- Animal Hospital In Crystal Lake Il

- El Jefe Taqueria Boston

- Words Don T Come Easy Lyrics

- Courtyard St Charles Il

- Serenity Massage North Andover Ma

Turbo Tax Advance Refund 2024 Turbotax Mei Dorette

Turbo Tax Advance Refund 2024 Turbotax Mei Dorette

Turbo Tax Advance Refund 2024 Turbotax Mei Dorette