Best Real Estate Investment Cities: Your Ultimate Guide

Real estate investment has become one of the most lucrative opportunities for investors worldwide. Whether you're looking to grow your wealth or secure long-term financial stability, choosing the right city is paramount. This article dives deep into the best real estate investment cities, offering actionable insights and expert advice.

Investing in real estate requires careful consideration of various factors, such as market trends, economic stability, and growth potential. In this guide, we will explore the top cities where real estate investments are not only profitable but also sustainable in the long run.

From bustling urban centers to emerging markets, we'll highlight the cities that offer the highest returns on investment while minimizing risks. Whether you're a seasoned investor or just starting out, this article will equip you with the knowledge you need to make informed decisions.

- The Sebastian Vail Village

- Glass Stuck In Foot

- Crunch Fitness Fern Creek

- What S The Capital Of Monaco

- Where To Get A Husky Dog

Table of Contents

- Overview of Real Estate Investment

- Key Criteria for Selecting the Best Cities

- Top 10 Best Real Estate Investment Cities

- Emerging Real Estate Markets

- Understanding Risks and Challenges

- Tips for Successful Real Estate Investments

- Real Estate Investment Statistics

- Future Trends in Real Estate Investment

- Conclusion

Overview of Real Estate Investment

Real estate investment involves purchasing, owning, leasing, or selling properties with the goal of generating income or capital appreciation. The success of such investments heavily relies on selecting the right location. Cities with robust economies, growing populations, and favorable real estate policies are often the best choices for investors.

According to a report by Realtor.com, the global real estate market is expected to grow steadily over the next decade, driven by urbanization and technological advancements. Investors who focus on high-demand cities can capitalize on these trends and achieve significant returns.

This section will provide a foundational understanding of what makes a city ideal for real estate investment, including factors like economic growth, infrastructure development, and demographic shifts.

- West Point Military Academy Address Zip Code

- Miranda Lambert Country Music Awards

- Andretti Karting Atlanta Ga

- Gospel Choir Christmas Music

- Pymatuning State Park Spillway

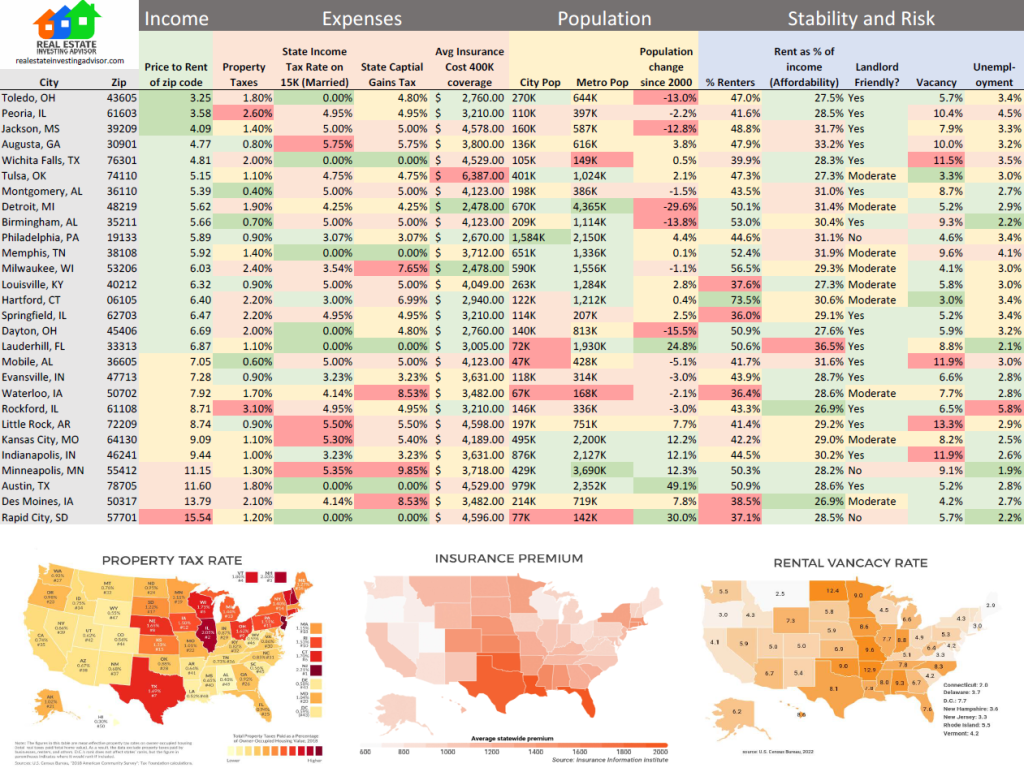

Key Criteria for Selecting the Best Cities

When evaluating cities for real estate investment, several key criteria should be considered:

- Economic stability and growth

- Population trends and migration patterns

- Infrastructure development and urban planning

- Local real estate regulations and policies

- Historical performance of the real estate market

By analyzing these factors, investors can identify cities that offer the most promising opportunities. For instance, cities with growing populations often experience increased demand for housing, leading to higher property values and rental yields.

Top 10 Best Real Estate Investment Cities

1. New York City

New York City remains one of the top destinations for real estate investment due to its vibrant economy and diverse population. The city's real estate market is characterized by high demand for residential, commercial, and retail spaces.

Key highlights of New York City's real estate market include:

- Strong rental demand driven by tourists, students, and professionals

- High property values with steady appreciation rates

- Robust infrastructure supporting urban development

2. Los Angeles

Los Angeles offers a unique blend of entertainment, technology, and real estate opportunities. The city's booming tech scene and entertainment industry attract a steady influx of professionals, driving up property prices.

Los Angeles is particularly attractive for investors seeking:

- Luxury real estate opportunities

- Access to entertainment industry networks

- High rental yields in urban areas

3. Miami

Miami has emerged as a global hub for real estate investment, thanks to its strategic location and favorable tax policies. The city's proximity to Latin America makes it an ideal gateway for international investors.

Investors in Miami benefit from:

- Year-round warm climate attracting global buyers

- Rapid urban development and infrastructure projects

- Strong demand for luxury condos and vacation homes

4. Toronto

Toronto stands out as one of the fastest-growing cities in North America, offering excellent opportunities for real estate investors. The city's diverse economy and multicultural population drive demand for housing and commercial spaces.

Toronto's real estate market is characterized by:

- Stable property values with consistent growth

- Government incentives for urban development

- High demand for rental properties

5. Sydney

Sydney is a prime destination for real estate investment in Australia, known for its stunning landscapes and thriving economy. The city's real estate market is driven by strong population growth and increasing urbanization.

Key advantages of investing in Sydney include:

- High-quality infrastructure and public transportation

- Strong demand for residential and commercial properties

- Government support for sustainable urban development

Emerging Real Estate Markets

In addition to established cities, several emerging markets offer exciting opportunities for real estate investors. These cities may not yet have the same level of recognition but are poised for significant growth in the near future.

Some of the most promising emerging markets include:

- Bangkok, Thailand

- Bangalore, India

- Istanbul, Turkey

- Sao Paulo, Brazil

Investors who enter these markets early can capitalize on lower property prices and higher growth potential. However, it's essential to conduct thorough research and understand local regulations before making any investment decisions.

Understanding Risks and Challenges

While real estate investment can be highly rewarding, it's not without risks. Investors must be aware of potential challenges, such as:

- Economic downturns affecting property values

- Changes in government policies and regulations

- Fluctuations in interest rates and financing options

To mitigate these risks, investors should diversify their portfolios, conduct thorough market research, and work with experienced real estate professionals.

Tips for Successful Real Estate Investments

To maximize your returns on real estate investments, consider the following tips:

- Focus on cities with strong economic fundamentals

- Invest in properties with high rental demand

- Stay informed about market trends and emerging opportunities

- Work with reputable real estate agents and advisors

By following these strategies, you can increase your chances of success in the competitive world of real estate investment.

Real Estate Investment Statistics

Data and statistics play a crucial role in making informed investment decisions. Here are some key statistics to consider:

- Global real estate investment reached $1.7 trillion in 2022, according to PwC.

- Residential property prices in major cities have increased by an average of 5% annually over the past decade.

- Commercial real estate investments account for approximately 40% of the global real estate market.

These figures underscore the importance of choosing the right cities and property types for investment.

Future Trends in Real Estate Investment

The real estate industry is continuously evolving, driven by technological advancements and changing consumer preferences. Some of the key trends shaping the future of real estate investment include:

- Increased adoption of smart home technologies

- Growing focus on sustainable and eco-friendly buildings

- Rise of remote work influencing property demand

Investors who stay ahead of these trends can position themselves for long-term success in the real estate market.

Conclusion

Investing in real estate requires careful planning and strategic decision-making. By focusing on the best real estate investment cities, you can maximize your returns while minimizing risks. Whether you choose established markets like New York or emerging cities like Bangkok, the key is to conduct thorough research and partner with experienced professionals.

We encourage you to share your thoughts and experiences in the comments below. Additionally, explore other articles on our site for more insights into real estate investment and related topics. Together, let's build a brighter financial future!

- Smoking Jerky On A Traeger

- Air Force Bases Wyoming

- Westland Shopping Center Photos

- Hotel The Hague Marriott

- Shoe Stores At University Park Mall

2023 Best Real Estate Investment Cities Compared

The Best Cities for Real Estate Investment mmminimal

Best Real Estate Investment Cities In Usa Invest Walls