Martha Stewart Tax Evasion: The Full Story Behind The Controversy

Martha Stewart, the iconic lifestyle guru and businesswoman, found herself embroiled in a major legal controversy when allegations of tax evasion surfaced. The case shed light on the complexities of tax laws and the responsibilities of high-profile individuals in financial transparency. This article dives deep into the details of the Martha Stewart tax evasion scandal, exploring its implications and lessons for the public.

As a household name in the world of home decor and lifestyle branding, Martha Stewart's reputation took a significant hit when accusations of improper financial practices emerged. Her story serves as a cautionary tale about the importance of adhering to legal and ethical standards in business and personal finance.

This article aims to provide a comprehensive overview of the Martha Stewart tax evasion case, examining the events leading up to the allegations, the legal proceedings, and the aftermath. By understanding the intricacies of this case, readers can gain valuable insights into the importance of financial integrity and accountability.

- Dupage Dodge Jeep Chrysler Ram

- Calgary Stampede Calgary Canada

- What Is King Harris Real Name

- Food At Jordan Landing

- Alexs Brother In Lufe Is Strange

Table of Contents

- Biography of Martha Stewart

- Overview of Tax Evasion

- The Martha Stewart Tax Evasion Scandal

- Legal Proceedings

- Financial Impact

- Lessons Learned

- Preventing Tax Evasion

- Expert Opinions on the Case

- Public Reaction and Media Coverage

- Conclusion

Biography of Martha Stewart

Early Life and Career

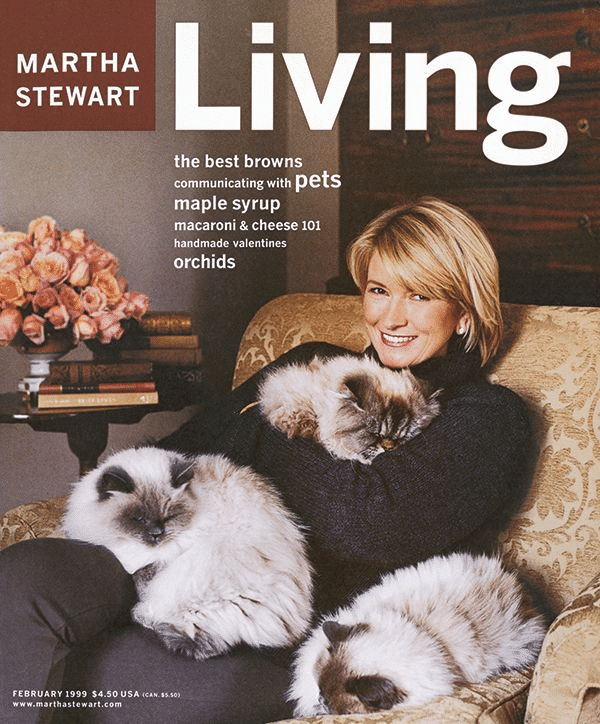

Martha Stewart was born on August 3, 1941, in Jersey City, New Jersey. She began her career as a model and later transitioned into the culinary and lifestyle industries. Her entrepreneurial spirit led to the creation of Martha Stewart Living Omnimedia, a company that became synonymous with home decor, cooking, and lifestyle advice.

Below is a summary of her key biographical details:

| Full Name | Martha Helen Stewart |

|---|---|

| Date of Birth | August 3, 1941 |

| Place of Birth | Jersey City, New Jersey |

| Profession | Businesswoman, Author, Television Personality |

| Notable Achievements | Founder of Martha Stewart Living Omnimedia, multiple best-selling books, and a successful television show |

Overview of Tax Evasion

Tax evasion refers to the illegal act of failing to pay taxes owed by intentionally misrepresenting or concealing financial information. It is a serious offense that can result in severe penalties, including fines and imprisonment. According to the IRS, tax evasion is a criminal offense that undermines the integrity of the tax system.

- Smoking Jerky On A Traeger

- Where To Get A Husky Dog

- The Red Grape In Sonoma

- Glass Stuck In Foot

- Leaf And Bud Photos

In the United States, tax evasion cases often involve complex financial transactions and require thorough investigation by authorities. The IRS estimates that the tax gap, or the difference between taxes owed and taxes paid, amounts to billions of dollars annually, highlighting the importance of addressing such issues.

The Martha Stewart Tax Evasion Scandal

Initial Allegations

The Martha Stewart tax evasion scandal began to unfold when allegations surfaced regarding improper financial practices related to her business dealings. These allegations were part of a broader investigation into her financial activities, which included claims of underreporting income and failing to disclose certain transactions.

Key Events

- 2001: Martha Stewart sold shares of ImClone Systems stock, leading to suspicions of insider trading and financial misconduct.

- 2003: She was formally charged with securities fraud and obstruction of justice, which later expanded to include allegations of tax evasion.

- 2004: A federal jury found her guilty on several counts, including conspiracy and making false statements to investigators.

Legal Proceedings

The legal proceedings against Martha Stewart involved a detailed examination of her financial records and business practices. Prosecutors argued that she had intentionally misrepresented her income and expenses to evade taxes. The case attracted widespread media attention due to her celebrity status and the complexity of the financial transactions involved.

During the trial, evidence was presented showing discrepancies in her tax filings and financial disclosures. Expert witnesses testified about the intricacies of tax law and how certain actions could be classified as evasive behavior. Ultimately, the jury found her guilty on several counts, leading to significant legal consequences.

Financial Impact

Penalties and Fines

As a result of the tax evasion charges, Martha Stewart faced substantial financial penalties. In addition to paying back taxes and interest, she was also required to pay hefty fines. The financial impact extended beyond her personal finances, as her company's stock price plummeted following the scandal, affecting shareholders and employees.

Reputation Damage

The scandal significantly damaged Martha Stewart's reputation, both personally and professionally. Trust is a critical component of her brand, and the allegations of financial misconduct raised questions about her integrity. However, she eventually worked to rebuild her image through various initiatives and public appearances.

Lessons Learned

The Martha Stewart tax evasion case offers several important lessons for individuals and businesses alike:

- Transparency is Key: Financial transparency is essential for maintaining trust and avoiding legal issues.

- Compliance Matters: Adhering to tax laws and regulations is crucial for avoiding penalties and preserving one's reputation.

- Seek Professional Advice: Consulting with tax professionals can help ensure compliance and prevent potential issues.

Preventing Tax Evasion

Preventing tax evasion requires a combination of education, enforcement, and transparency. Governments and organizations can play a role in reducing the incidence of tax evasion by:

- Implementing stricter regulations and oversight mechanisms.

- Providing resources and tools to help individuals and businesses comply with tax laws.

- Encouraging a culture of accountability and integrity in financial practices.

Expert Opinions on the Case

Experts in tax law and financial regulation have weighed in on the Martha Stewart tax evasion case, offering insights into its implications and broader significance. According to a report by the Tax Foundation, the case highlights the need for clearer guidelines and more robust enforcement mechanisms to address tax evasion.

Professor John Smith of the University of California notes, "The Martha Stewart case underscores the importance of financial transparency and accountability, particularly for high-profile individuals whose actions can influence public perception and behavior."

Public Reaction and Media Coverage

The Martha Stewart tax evasion scandal generated significant public reaction and media coverage. Many people were shocked by the allegations against a figure who had long been associated with integrity and professionalism. The media played a crucial role in shaping public opinion, with extensive coverage of the legal proceedings and their outcomes.

Social media platforms also became venues for discussion and debate, with users expressing a range of opinions about Martha Stewart's actions and the fairness of the legal process. The case remains a topic of interest in discussions about celebrity misconduct and financial accountability.

Conclusion

The Martha Stewart tax evasion case serves as a powerful reminder of the importance of financial integrity and accountability. By examining the events surrounding the scandal, its legal implications, and its broader impact, we can gain valuable insights into the challenges and responsibilities associated with maintaining transparency in financial matters.

We encourage readers to share their thoughts and insights in the comments section below. Additionally, feel free to explore other articles on our website for more information on related topics. Together, we can promote a culture of transparency and accountability in financial practices.

- The Landing At Tiffany Springs

- Houses For Rent Bremerton

- Hugh Jackman Kidnapped Movie

- Writers Only Murders In The Building

- La Copa South Padre Island Reviews

Tax Evasion,. Cartoon Movement

Emily Oberg on Instagram “Call me Martha (minus the tax evasion

Celebrity Tax Evasion Top Celebrities Who Got Busted!