Can I Use Affirm For Groceries? A Comprehensive Guide To Financing Your Grocery Needs

With the rise of flexible payment options, many consumers are curious about whether they can use Affirm for groceries. Affirm, a popular buy-now-pay-later (BNPL) service, allows users to make purchases and pay them off over time without accumulating interest. But does this service extend to everyday grocery shopping? In this article, we will explore everything you need to know about using Affirm for groceries.

As the world shifts toward more convenient and flexible payment methods, it’s essential to understand what services like Affirm offer. While Affirm is widely known for its use in retail, home goods, and even medical expenses, the question of whether it can be applied to grocery shopping remains a common query.

This article will break down the possibilities of using Affirm for groceries, the benefits and drawbacks, and provide actionable insights for those considering this payment method. Let’s dive in!

- Golden Era San Francisco

- The Landing At Tiffany Springs

- Family Care Eye Center

- Shoe Stores At University Park Mall

- Hy Vee Online Orders

Table of Contents

- What is Affirm?

- Can You Use Affirm for Groceries?

- How Does Affirm Work?

- Benefits of Using Affirm

- Drawbacks of Affirm

- Grocery Stores That Accept Affirm

- Alternatives to Affirm for Groceries

- Tips for Using Affirm

- FAQ About Affirm

- Conclusion

What is Affirm?

Affirm is a buy-now-pay-later (BNPL) platform that allows consumers to pay for purchases over time without incurring interest. Unlike traditional credit cards, Affirm offers fixed monthly payments with transparent terms, making it an attractive option for many shoppers. The service is available at various retailers, ranging from online stores to brick-and-mortar locations.

Key Features of Affirm

- No interest charges

- Fixed monthly payments

- Transparent terms and conditions

- Available for both large and small purchases

Affirm’s mission is to provide financial freedom to consumers by offering flexible payment options without hidden fees or surprises. This makes it an appealing choice for those looking to manage their finances more effectively.

Can You Use Affirm for Groceries?

While Affirm is widely used in retail and e-commerce, its application for grocery shopping is limited. Currently, most grocery stores do not accept Affirm as a payment method. However, there are a few exceptions where specific retailers partner with Affirm to offer this service.

- 30 Inch Tv Vizio

- Midwest Wine Making Supplies

- Earls Funeral Home Barbados

- Indiana Beach Amusement And Water Park

- Why Is Cvs Charging Me 5 A Month

Why Aren’t More Grocery Stores Accepting Affirm?

Grocery shopping typically involves smaller, more frequent purchases, which may not align with Affirm’s business model. Affirm tends to focus on larger ticket items, such as electronics, furniture, or home appliances. Additionally, the logistics of integrating Affirm into grocery store payment systems can be complex.

How Does Affirm Work?

Using Affirm is straightforward. When making a purchase at a participating retailer, you can choose Affirm as your payment method. The platform will then assess your creditworthiness and offer you a loan for the purchase amount. You can select from various repayment plans, typically ranging from a few months to several years.

Steps to Use Affirm

- Select your desired product at a participating retailer.

- Choose Affirm as your payment method during checkout.

- Enter your personal information to complete the application process.

- Select a repayment plan that suits your budget.

- Confirm your purchase and start making payments.

Affirm’s user-friendly interface and quick approval process make it an ideal choice for those seeking financial flexibility.

Benefits of Using Affirm

Using Affirm for groceries, or any other purchase, comes with several advantages:

1. No Interest Payments

One of the most significant benefits of Affirm is that it does not charge interest on loans. This makes it a cost-effective option compared to traditional credit cards, which often come with high interest rates.

2. Predictable Payments

Affirm offers fixed monthly payments, allowing users to budget more effectively. This predictability can help you avoid unexpected expenses and maintain financial stability.

3. Transparent Terms

Affirm prides itself on transparency. Users are informed of all fees and terms upfront, ensuring there are no hidden costs or surprises.

Drawbacks of Affirm

While Affirm offers numerous benefits, it’s essential to consider its limitations:

1. Limited Acceptance

Not all retailers, especially grocery stores, accept Affirm as a payment method. This can be a significant drawback for those hoping to use it for everyday purchases.

2. Credit Check Requirement

Affirm conducts a credit check during the application process, which may impact your credit score. While this is a standard practice for most lenders, it’s something to consider before using the service.

3. Potential for Overspending

With the convenience of pay-later services, some users may find themselves overspending. It’s crucial to use Affirm responsibly and only for purchases within your budget.

Grocery Stores That Accept Affirm

Currently, very few grocery stores accept Affirm as a payment method. However, some retailers that offer grocery delivery services may partner with Affirm. For instance:

- Instacart: While Instacart itself does not accept Affirm, certain retailers within its network may offer this option.

- Walmart: Walmart has experimented with Affirm for certain categories, but it is not widely available for groceries.

It’s essential to check with individual retailers to confirm their payment options.

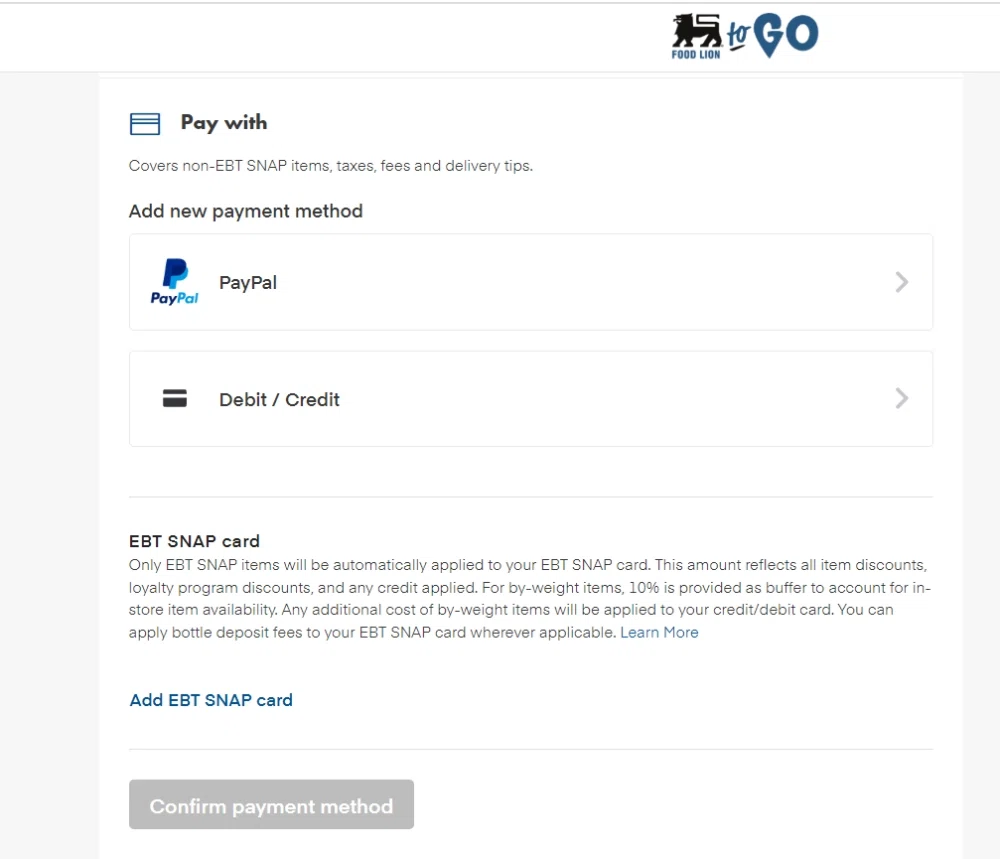

Alternatives to Affirm for Groceries

For those unable to use Affirm for groceries, there are several alternatives:

1. Credit Cards

Credit cards remain a popular choice for grocery shopping. Many cards offer rewards programs, cashback, or points for everyday purchases.

2. Debit Cards

Using a debit card ensures you only spend what you have, helping you avoid debt. Many grocery stores also offer cashback options when using a debit card.

3. Store-Specific Financing

Some grocery chains offer their own financing options or loyalty programs that provide discounts and rewards for frequent shoppers.

Tips for Using Affirm

If you decide to use Affirm for groceries or other purchases, consider the following tips:

- Only use Affirm for purchases you can afford.

- Read the terms and conditions carefully before signing up.

- Set reminders for your monthly payments to avoid late fees.

- Monitor your credit score regularly to ensure Affirm’s impact is positive.

By following these guidelines, you can make the most of Affirm while maintaining financial responsibility.

FAQ About Affirm

1. Is Affirm Safe to Use?

Yes, Affirm is a secure and reputable platform. It employs robust security measures to protect user data and transactions.

2. Does Affirm Affect My Credit Score?

Affirm conducts a hard credit check during the application process, which may slightly impact your credit score. However, timely payments can help improve your credit over time.

3. Can I Use Affirm for Other Everyday Expenses?

While Affirm is primarily designed for larger purchases, some retailers may offer it for everyday items. It’s always best to check with the specific merchant.

Conclusion

Can I use Affirm for groceries? The answer is generally no, as most grocery stores do not accept Affirm as a payment method. However, there are exceptions, and the service continues to expand its reach. For those seeking financial flexibility, Affirm offers a transparent and convenient way to manage larger purchases.

While Affirm may not be ideal for grocery shopping, it remains a valuable tool for other types of expenses. By understanding its benefits and limitations, you can make informed decisions about your finances.

We encourage you to share your thoughts and experiences with Affirm in the comments below. Additionally, feel free to explore other articles on our site for more insights into personal finance and payment solutions.

- Earls Funeral Home Barbados

- Doubletree Hotel International Drive Orlando Fl

- Dupage Dodge Jeep Chrysler Ram

- Words Don T Come Easy Lyrics

- Where Is The Legacy Museum

Can you buy groceries with Affirm? Leia aqui Can you use Affirm on

Can you buy groceries with Affirm? Leia aqui Can you use Affirm on

Ways Your Customers Can Use Affirm The Affirm App Affirm US (English)