Bookmap For Stocks Vs Futures: A Comprehensive Guide For Traders

Trading financial markets has evolved significantly with advanced tools like Bookmap, offering traders unparalleled insights into stocks and futures markets. If you're looking to understand how Bookmap works for stocks versus futures, this article provides an in-depth analysis to help you make informed decisions. Whether you're a beginner or an experienced trader, understanding the nuances of Bookmap for both asset classes is crucial for success.

In today's fast-paced financial world, traders need more than just basic charts and indicators. They require real-time depth of market (DOM) data, order flow analytics, and advanced visualization tools. Bookmap, a cutting-edge trading platform, delivers exactly that. By comparing its application for stocks and futures, traders can better align their strategies with their goals.

This article will explore the features of Bookmap tailored for stocks and futures, analyze their differences, and provide actionable insights. By the end, you'll have a clear understanding of how Bookmap can enhance your trading journey, regardless of which market you choose to focus on.

- Hotel The Hague Marriott

- The Sebastian Vail Village

- Pymatuning State Park Spillway

- 30 Inch Tv Vizio

- Houses For Rent Bremerton

Table of Contents

- Introduction to Bookmap

- Bookmap for Stocks

- Bookmap for Futures

- Key Differences Between Stocks and Futures on Bookmap

- Technical Aspects of Bookmap

- Benefits of Using Bookmap

- Common Mistakes to Avoid

- Best Practices for Using Bookmap

- Case Studies: Success Stories with Bookmap

- Conclusion

Introduction to Bookmap

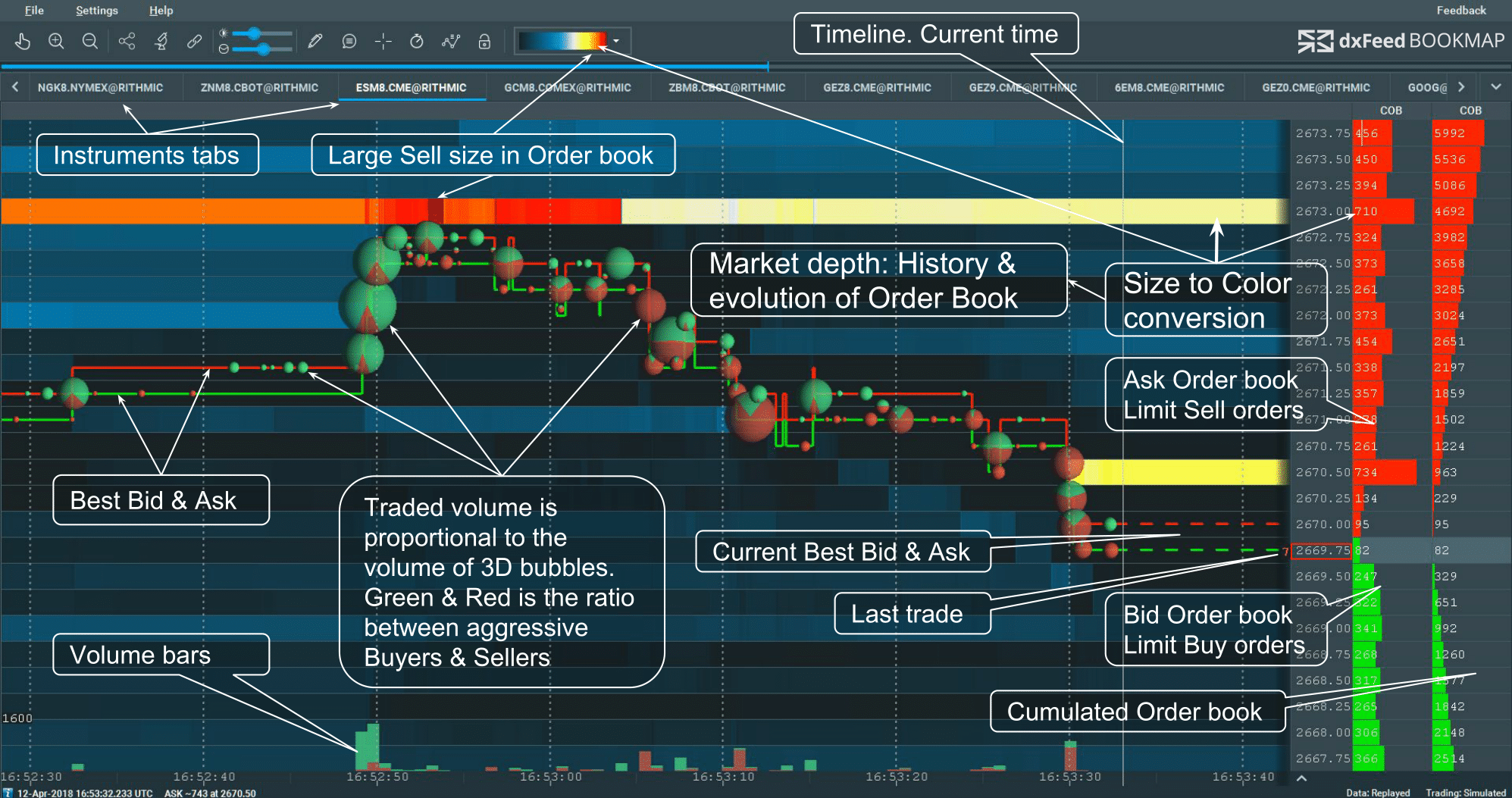

Bookmap is a powerful trading tool designed to provide traders with real-time market depth data and advanced visualization capabilities. It allows users to see the order book dynamics, helping them make more informed decisions. Whether you're trading stocks or futures, Bookmap offers features that cater to both markets, albeit with some variations.

The platform is particularly useful for traders who want to understand market sentiment and order flow. By visualizing the order book in real-time, traders can identify liquidity pockets, price levels, and potential market moves. This level of insight is invaluable, especially in fast-moving markets like futures.

- Woodinville Department Of Licensing

- Grant Holloway And Chase

- Donde Esta La Ingle De La Mujer

- Bj S Restaurant In Carlsbad

- Why Is Cvs Charging Me 5 A Month

Why Bookmap Stands Out

Bookmap stands out due to its ability to provide traders with a competitive edge. Unlike traditional charting tools, Bookmap focuses on the order book, which is the backbone of any financial market. By analyzing order flow, traders can anticipate price movements and adjust their strategies accordingly.

- Real-time depth of market data

- Advanced visualization tools

- Customizable interface

- Integration with popular trading platforms

Bookmap for Stocks

When it comes to trading stocks, Bookmap offers a unique perspective that traditional charting tools cannot provide. By visualizing the order book, traders can see the liquidity available at different price levels, helping them execute trades more efficiently.

Key Features for Stock Traders

Bookmap's features for stock traders include:

- Real-time order book visualization

- Heatmap representation of order flow

- Customizable alerts for key price levels

- Integration with brokerage platforms for seamless execution

Stock traders can benefit from Bookmap's ability to highlight areas of support and resistance, which are crucial for executing trades with precision. The platform also allows traders to backtest their strategies using historical data, ensuring that their decisions are based on sound analysis.

Bookmap for Futures

Futures trading is inherently fast-paced, making it essential for traders to have access to real-time data and analytics. Bookmap excels in this area, providing futures traders with the tools they need to succeed in volatile markets.

How Bookmap Enhances Futures Trading

Bookmap enhances futures trading by offering:

- Real-time order book updates

- Advanced charting tools

- Customizable indicators for technical analysis

- Integration with futures-specific trading platforms

Futures traders can leverage Bookmap's features to identify trends, analyze order flow, and execute trades with precision. The platform's ability to visualize market depth in real-time is particularly beneficial in futures markets, where liquidity can change rapidly.

Key Differences Between Stocks and Futures on Bookmap

While Bookmap offers similar features for both stocks and futures, there are some key differences that traders should be aware of. Understanding these differences can help traders optimize their use of the platform for each market.

Market Structure

The structure of the stock market differs significantly from that of the futures market. Stocks are traded on exchanges, while futures are traded on centralized exchanges. This difference affects how the order book is displayed and how liquidity is distributed.

Liquidity

Liquidity is generally higher in futures markets compared to stocks. Bookmap reflects this by providing more detailed order book data for futures, allowing traders to see deeper levels of liquidity.

Technical Aspects of Bookmap

From a technical perspective, Bookmap is designed to handle large volumes of data in real-time. The platform uses advanced algorithms to process and display market data, ensuring that traders have access to the most up-to-date information.

Data Processing

Bookmap processes data using high-frequency algorithms that update the order book in real-time. This ensures that traders always have the latest information at their fingertips.

Visualization Techniques

The platform employs various visualization techniques to make complex data more accessible. Heatmaps, for example, are used to represent order flow, making it easier for traders to identify trends and patterns.

Benefits of Using Bookmap

Using Bookmap offers numerous benefits for traders, regardless of whether they focus on stocks or futures. These benefits include:

- Improved decision-making through real-time data

- Enhanced ability to identify trends and patterns

- Increased trading efficiency through customizable tools

- Reduced risk through better understanding of market dynamics

By leveraging these benefits, traders can gain a competitive edge in the market and improve their overall performance.

Common Mistakes to Avoid

While Bookmap is a powerful tool, it's important for traders to avoid common mistakes that can hinder their success. These mistakes include:

- Over-reliance on the platform without considering other factors

- Ignoring market fundamentals in favor of technical analysis

- Not customizing the platform to suit individual trading styles

Avoiding these mistakes can help traders make the most of Bookmap's capabilities and achieve better results.

Best Practices for Using Bookmap

To get the most out of Bookmap, traders should follow these best practices:

- Customize the platform to match your trading strategy

- Use historical data to backtest your strategies

- Stay informed about market news and developments

- Continuously educate yourself on trading techniques

By following these practices, traders can enhance their experience with Bookmap and improve their trading outcomes.

Case Studies: Success Stories with Bookmap

Several traders have achieved success using Bookmap for both stocks and futures. One trader, for example, used the platform's order book visualization to identify a key support level in a futures contract, allowing them to execute a profitable trade. Another trader utilized Bookmap's heatmap feature to spot a breakout in a stock, resulting in significant gains.

Learning from Success Stories

By studying these success stories, traders can learn valuable lessons about how to use Bookmap effectively. Each case highlights the importance of understanding market dynamics and leveraging the platform's features to make informed decisions.

Conclusion

In conclusion, Bookmap is a powerful tool for traders looking to gain a competitive edge in the markets. Whether you're trading stocks or futures, the platform offers features that can enhance your trading experience and improve your results. By understanding the differences between the two markets and following best practices, traders can make the most of Bookmap's capabilities.

We encourage you to share your thoughts and experiences with Bookmap in the comments section below. Additionally, feel free to explore other articles on our site for more insights into trading and financial markets. Thank you for reading, and happy trading!

Data sources: Bookmap, Investopedia, CME Group.

- Shoe Stores At University Park Mall

- Glass Stuck In Foot

- Miranda Lambert Country Music Awards

- What Does Aces Tattoo Stand For

- Why Is Cvs Charging Me 5 A Month

dxFeed launched US Futures data for Bookmap

binance futures logo Bookmap

dxFeed Bookmap Product Description