Understanding CC DR 050: A Comprehensive Guide

CC DR 050 is a term that has gained significant attention in recent years, especially within the financial and banking sectors. It refers to a specific code used in credit card transactions that can significantly impact your financial health. Understanding this concept is crucial for anyone who wants to manage their finances effectively and avoid potential pitfalls.

In today's fast-paced world, credit card usage has become an integral part of daily life. However, with the convenience of credit cards comes the responsibility of understanding various codes and terms, such as CC DR 050. This article will delve deep into the meaning, implications, and strategies to manage this code effectively.

Whether you are a seasoned credit card user or a newcomer, this guide will provide valuable insights into CC DR 050. By the end of this article, you will have a comprehensive understanding of how to navigate this aspect of your financial life.

- Sexiest Just For Laughs Gags

- It Ends With Us Showtimes Near Viking 3

- Serenity Massage North Andover Ma

- Writers Only Murders In The Building

- Little House On The Prairie Mary Blind

Table of Contents

- What is CC DR 050?

- History of CC DR 050

- Key Components of CC DR 050

- Impact on Personal Finances

- Strategies to Avoid CC DR 050 Issues

- Real-Life Examples of CC DR 050

- Common Mistakes to Avoid

- Legal Aspects of CC DR 050

- Future Trends in CC DR 050

- Conclusion

What is CC DR 050?

CC DR 050 refers to a specific code in credit card transactions that denotes a discrepancy or issue in the transaction process. This code is typically used by banks and financial institutions to flag transactions that require further investigation. Understanding what this code means is essential for maintaining a healthy financial record.

This code is often associated with declined transactions, fraudulent activities, or incorrect billing. It acts as a safeguard for both consumers and financial institutions by identifying potential problems early in the transaction process.

Key Variations:

- What Is King Harris Real Name

- Houses For Rent Bremerton

- Who Is Moriah Plath S Ex Boyfriend

- Why Is Blueface Facing 4 Years

- What Cancer Did Gabe Solis Died From

- CC DR 050 Error

- Transaction Discrepancy Code

- Declined Credit Card Transaction

History of CC DR 050

The origins of CC DR 050 can be traced back to the early days of electronic banking systems. As credit card usage became more widespread, the need for a standardized system to identify and address transaction issues became apparent. Financial institutions developed various codes, including CC DR 050, to streamline this process.

Over the years, the code has evolved to encompass a broader range of transaction issues. Advances in technology and increased sophistication in fraud detection have further refined its application.

Early Development of the Code

In the 1980s, when electronic payment systems were still in their infancy, the need for a systematic approach to address transaction issues was first recognized. This led to the creation of early versions of codes like CC DR 050.

Key Components of CC DR 050

This section breaks down the essential components of CC DR 050, providing a deeper understanding of its mechanics.

- Transaction Identification: The code helps identify specific transactions that require attention.

- Security Measures: It acts as a security feature to prevent fraudulent activities.

- Customer Notification: Alerts customers about potential issues in their transactions.

Technical Details of CC DR 050

From a technical standpoint, CC DR 050 involves complex algorithms and data analysis to detect anomalies in transactions. Financial institutions employ advanced software to monitor and flag transactions that match the criteria for this code.

Impact on Personal Finances

The presence of CC DR 050 in your credit card transactions can have significant implications for your personal finances. It may lead to declined transactions, additional fees, or even account suspension if not addressed promptly.

Understanding the impact of this code is crucial for maintaining a positive credit score and avoiding unnecessary financial stress.

Financial Consequences of CC DR 050

Some of the potential financial consequences include:

- Increased interest rates

- Additional transaction fees

- Damage to credit score

Strategies to Avoid CC DR 050 Issues

To minimize the risk of encountering CC DR 050 issues, it is essential to adopt proactive strategies. These strategies include:

- Regularly monitoring your credit card statements

- Setting up transaction alerts

- Using secure payment methods

Implementing these strategies can significantly reduce the likelihood of encountering transaction issues.

Best Practices for Credit Card Users

Best practices for managing credit card transactions include:

- Limiting card usage to trusted merchants

- Reviewing transaction details before finalizing purchases

- Reporting any suspicious activity immediately

Real-Life Examples of CC DR 050

To better understand the practical implications of CC DR 050, let us examine some real-life examples:

Example 1: A customer attempts to make a large purchase overseas, but the transaction is flagged with CC DR 050 due to unusual spending behavior. The bank contacts the customer to verify the transaction.

Example 2: A fraudulent transaction is detected on a customer's account, and CC DR 050 is applied to freeze the account until the issue is resolved.

Common Mistakes to Avoid

Many credit card users make common mistakes that can lead to CC DR 050 issues. These include:

- Ignoring transaction alerts

- Failing to update personal information with the bank

- Using unsecured Wi-Fi networks for online transactions

Avoiding these mistakes can help prevent unnecessary complications.

Tips for Prevention

To prevent common mistakes, consider the following tips:

- Regularly update your contact information with your bank

- Use strong passwords for online banking

- Monitor your credit report annually

Legal Aspects of CC DR 050

From a legal standpoint, CC DR 050 is governed by various regulations and consumer protection laws. Financial institutions must adhere to these regulations when applying this code to transactions.

Consumers have certain rights under these laws, including the right to dispute transactions and request investigations into flagged activities.

Consumer Protection Laws

Some key consumer protection laws include:

- Fair Credit Billing Act

- Electronic Fund Transfer Act

- Truth in Lending Act

Future Trends in CC DR 050

As technology continues to advance, the future of CC DR 050 is likely to involve even more sophisticated methods of detecting and addressing transaction issues. Artificial intelligence and machine learning are expected to play a significant role in enhancing the accuracy and efficiency of this process.

Financial institutions are also exploring new ways to enhance customer experience while maintaining security, such as biometric authentication and real-time transaction monitoring.

Innovations in Transaction Security

Innovations in transaction security include:

- Biometric verification

- Blockchain technology

- Advanced data analytics

Conclusion

In conclusion, understanding CC DR 050 is essential for anyone who uses credit cards. This code plays a vital role in ensuring the security and integrity of financial transactions. By adopting proactive strategies and staying informed about its implications, you can effectively manage your finances and avoid potential pitfalls.

We encourage you to share this article with others who may benefit from this information. For more insights into personal finance and credit card management, explore our other articles on the site. Your feedback and questions are always welcome!

- Food At Jordan Landing

- Rush Hour Go Karts Garner

- It Ends With Us Showtimes Near Viking 3

- Houses For Rent Bremerton

- Avli Little Greek Tavern

Phoenix knows LoveRush makes the best gift for moms 🥰💖 Enter to win a

Dr. Archika Didi

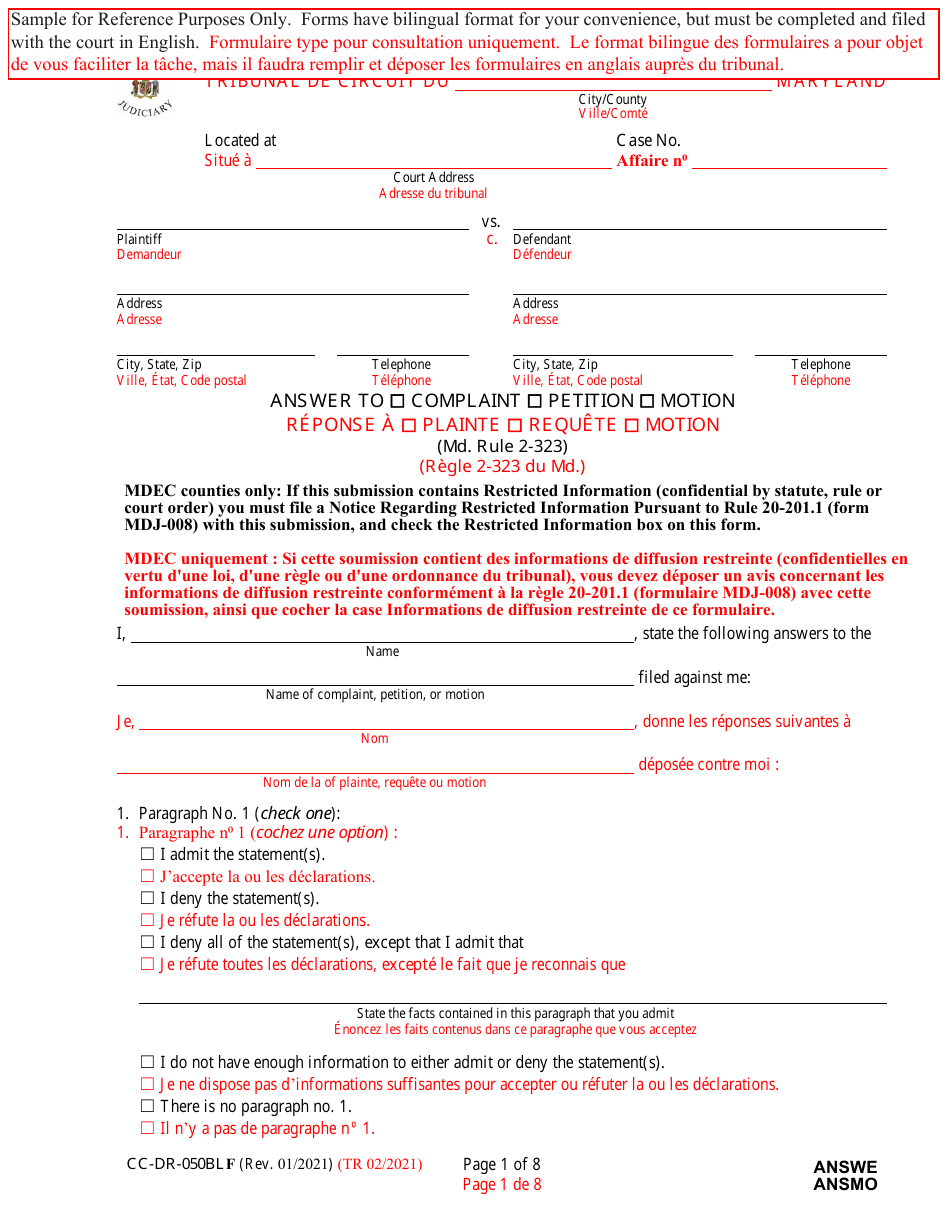

Form CCDR050BLF Fill Out, Sign Online and Download Fillable PDF