Is BlackRock Investing In XRP? A Comprehensive Analysis

BlackRock's potential involvement in XRP has become a hot topic in the cryptocurrency space, sparking curiosity and debate among investors and enthusiasts alike. As one of the largest asset management firms in the world, BlackRock's decisions can significantly influence the financial markets. This article delves deep into the relationship between BlackRock and XRP, exploring whether the financial giant is investing in this digital asset.

In recent years, the cryptocurrency market has witnessed tremendous growth, with institutions increasingly showing interest in blockchain technology and digital currencies. XRP, developed by Ripple Labs, stands out as one of the most promising cryptocurrencies due to its focus on fast and cost-effective cross-border transactions. Understanding BlackRock's stance on XRP is crucial for investors looking to make informed decisions.

This article aims to provide a detailed and balanced perspective on the subject, backed by credible sources and data. Whether you're a seasoned investor or just starting to explore the world of cryptocurrencies, this analysis will equip you with the knowledge you need to evaluate BlackRock's involvement in XRP.

- Mick Jagger S 8 Year Old Son Deveraux Resembles His Famous Father

- Curtis Ingraham Net Worth

- Indian Female Average Height

- Lake Travis Hs Football

- Where Can I Buy Used Musical Instruments

Table of Contents:

- BlackRock: A Brief Overview

- Is BlackRock Investing in XRP?

- What is XRP and Ripple?

- BlackRock's Investment Strategy in Cryptocurrencies

- Market Analysis: XRP's Potential

- Regulatory Challenges for XRP

- Risks and Opportunities in XRP Investment

- The Future of BlackRock and XRP

- Frequently Asked Questions

- Conclusion and Call to Action

BlackRock: A Brief Overview

BlackRock, founded in 1988, is the world's largest asset management firm, with over $10 trillion in assets under management. Headquartered in New York City, the company specializes in providing investment and risk management solutions to institutional and individual investors globally.

Key Facts About BlackRock

Below is a summary of BlackRock's key details:

- Sleep In Rehoboth Beach

- Hy Vee Online Orders

- La Copa South Padre Island Reviews

- Hugh Jackman Kidnapped Movie

- Grant Holloway And Chase

| Category | Details |

|---|---|

| Founding Year | 1988 |

| Headquarters | New York City, USA |

| Assets Under Management | $10+ trillion (as of 2023) |

| Founder | Laurence D. Fink |

| Focus | Institutional and retail asset management |

BlackRock's influence extends across various asset classes, including equities, fixed income, real estate, and alternative investments. Recently, the firm has shown interest in cryptocurrencies, signaling a shift toward embracing digital assets.

Is BlackRock Investing in XRP?

As of the latest reports, there is no concrete evidence to suggest that BlackRock is directly investing in XRP. However, the firm has demonstrated interest in the broader cryptocurrency market, particularly through its acquisition of Bitcoin-related products.

Exploring BlackRock's Cryptocurrency Ventures

While BlackRock's focus remains on established cryptocurrencies like Bitcoin and Ethereum, the company has not explicitly ruled out investments in other digital assets, including XRP. Below are some key developments:

- BlackRock launched a Bitcoin futures ETF in 2022.

- The firm partnered with Coinbase to integrate cryptocurrency into its investment offerings.

- BlackRock's CEO, Larry Fink, has expressed cautious optimism about the potential of blockchain technology.

Although XRP is not currently part of BlackRock's portfolio, the firm's growing interest in digital assets could pave the way for future investments in Ripple's native cryptocurrency.

What is XRP and Ripple?

XRP is the native cryptocurrency of the Ripple network, a blockchain-based payment protocol designed to facilitate fast and low-cost cross-border transactions. Launched in 2012, Ripple Labs aims to revolutionize global payments by offering an alternative to traditional banking systems.

Key Features of XRP

XRP boasts several advantages that make it an attractive option for institutional investors:

- Speed: Transactions on the XRP Ledger are confirmed in under 5 seconds.

- Cost-Effectiveness: XRP transactions incur minimal fees, making them ideal for large-scale transfers.

- Scalability: The XRP Ledger can handle up to 1,500 transactions per second, surpassing many other blockchain networks.

Despite its promising features, XRP faces regulatory challenges, particularly in the United States, where it is embroiled in a legal battle with the Securities and Exchange Commission (SEC).

BlackRock's Investment Strategy in Cryptocurrencies

BlackRock's approach to cryptocurrencies is characterized by a cautious yet strategic mindset. The firm prioritizes regulatory compliance, risk management, and long-term value creation when evaluating potential investments.

Factors Influencing BlackRock's Decisions

Several factors influence BlackRock's decision to invest in cryptocurrencies:

- Market demand: BlackRock considers the growing interest in digital assets from institutional and retail investors.

- Regulatory environment: The firm evaluates the legal and regulatory landscape surrounding cryptocurrencies in different jurisdictions.

- Technological innovation: BlackRock assesses the potential of blockchain technology to disrupt traditional financial systems.

While XRP aligns with some of these criteria, its ongoing legal issues with the SEC may deter BlackRock from making a direct investment at this time.

Market Analysis: XRP's Potential

XRP has demonstrated significant growth potential, with a market capitalization that places it among the top cryptocurrencies globally. However, its adoption faces challenges due to regulatory uncertainties and competition from other digital assets.

Growth Drivers for XRP

Factors contributing to XRP's potential include:

- Partnerships with financial institutions: Ripple has collaborated with banks and payment providers worldwide to integrate XRP into their systems.

- Emerging markets: XRP's low-cost transaction model appeals to developing countries with limited access to traditional banking services.

- Institutional interest: As more firms explore digital assets, XRP's unique use case could attract attention from large investors like BlackRock.

Despite these strengths, XRP must overcome regulatory hurdles to fully realize its potential and attract mainstream adoption.

Regulatory Challenges for XRP

The legal status of XRP remains a contentious issue, particularly in the United States. The SEC's lawsuit against Ripple Labs, alleging that XRP is an unregistered security, has cast a shadow over the cryptocurrency's future.

Potential Outcomes of the SEC Lawsuit

The outcome of the SEC's case against Ripple could have far-reaching implications for XRP:

- If XRP is classified as a security, it may face stricter regulations and reduced market access.

- If XRP is deemed a commodity, it could gain wider acceptance and attract more investors.

- A settlement or court ruling could clarify XRP's status, providing greater certainty for stakeholders.

Regulatory clarity is essential for XRP to gain traction in the institutional investment space, including potential interest from BlackRock.

Risks and Opportunities in XRP Investment

Investing in XRP presents both risks and opportunities for institutional investors like BlackRock. Understanding these factors is crucial for making informed decisions.

Risks Associated with XRP

Some of the risks involved in XRP investment include:

- Regulatory uncertainty: The ongoing SEC lawsuit poses a significant risk to XRP's future.

- Market volatility: Cryptocurrencies, including XRP, are subject to price fluctuations that can impact investment returns.

- Competition: XRP faces competition from other digital assets offering similar use cases.

Opportunities for XRP

Despite these risks, XRP offers several opportunities:

- Global adoption: XRP's focus on cross-border payments could drive widespread adoption in the financial sector.

- Technological innovation: Ripple's blockchain technology continues to evolve, enhancing its capabilities and appeal.

- Institutional interest: As more firms explore digital assets, XRP's unique value proposition could attract significant investment.

The Future of BlackRock and XRP

The relationship between BlackRock and XRP remains uncertain, with no immediate signs of direct investment. However, the growing interest in cryptocurrencies and blockchain technology suggests that BlackRock may consider XRP in the future, provided regulatory clarity is achieved.

Predictions for BlackRock's Crypto Strategy

Looking ahead, BlackRock is likely to:

- Expand its cryptocurrency offerings to include more digital assets beyond Bitcoin and Ethereum.

- Collaborate with regulatory bodies to ensure compliance and promote innovation in the digital asset space.

- Monitor developments in the XRP ecosystem, including the outcome of the SEC lawsuit, before making any investment decisions.

As the cryptocurrency market continues to evolve, BlackRock's involvement could play a pivotal role in shaping its trajectory.

Frequently Asked Questions

Q1: Why is BlackRock interested in cryptocurrencies?

BlackRock's interest in cryptocurrencies stems from the growing demand for digital assets among institutional and retail investors, as well as the potential of blockchain technology to transform traditional financial systems.

Q2: What is the current status of the SEC lawsuit against Ripple?

The SEC lawsuit against Ripple remains ongoing, with both parties presenting their arguments in court. The outcome of the case will have significant implications for XRP's future.

Q3: How does XRP differ from Bitcoin and Ethereum?

XRP focuses on fast and cost-effective cross-border transactions, while Bitcoin serves as a store of value and Ethereum supports decentralized applications through smart contracts.

Conclusion and Call to Action

In conclusion, while BlackRock is not currently investing in XRP, the firm's growing interest in cryptocurrencies suggests that future involvement is possible. XRP's potential as a transformative digital asset, coupled with its unique use case, makes it an attractive option for institutional investors. However, regulatory clarity and market stability are essential for attracting mainstream adoption.

We encourage readers to share their thoughts and insights in the comments section below. Additionally, consider exploring other articles on our website to deepen your understanding of the cryptocurrency market and its evolving landscape.

- When Did 3 Point Line Start In College

- It Ends With Us Showtimes Near Viking 3

- Doubletree Hotel International Drive Orlando Fl

- Where To Get A Husky Dog

- Amc Theaters Near Chicago Il

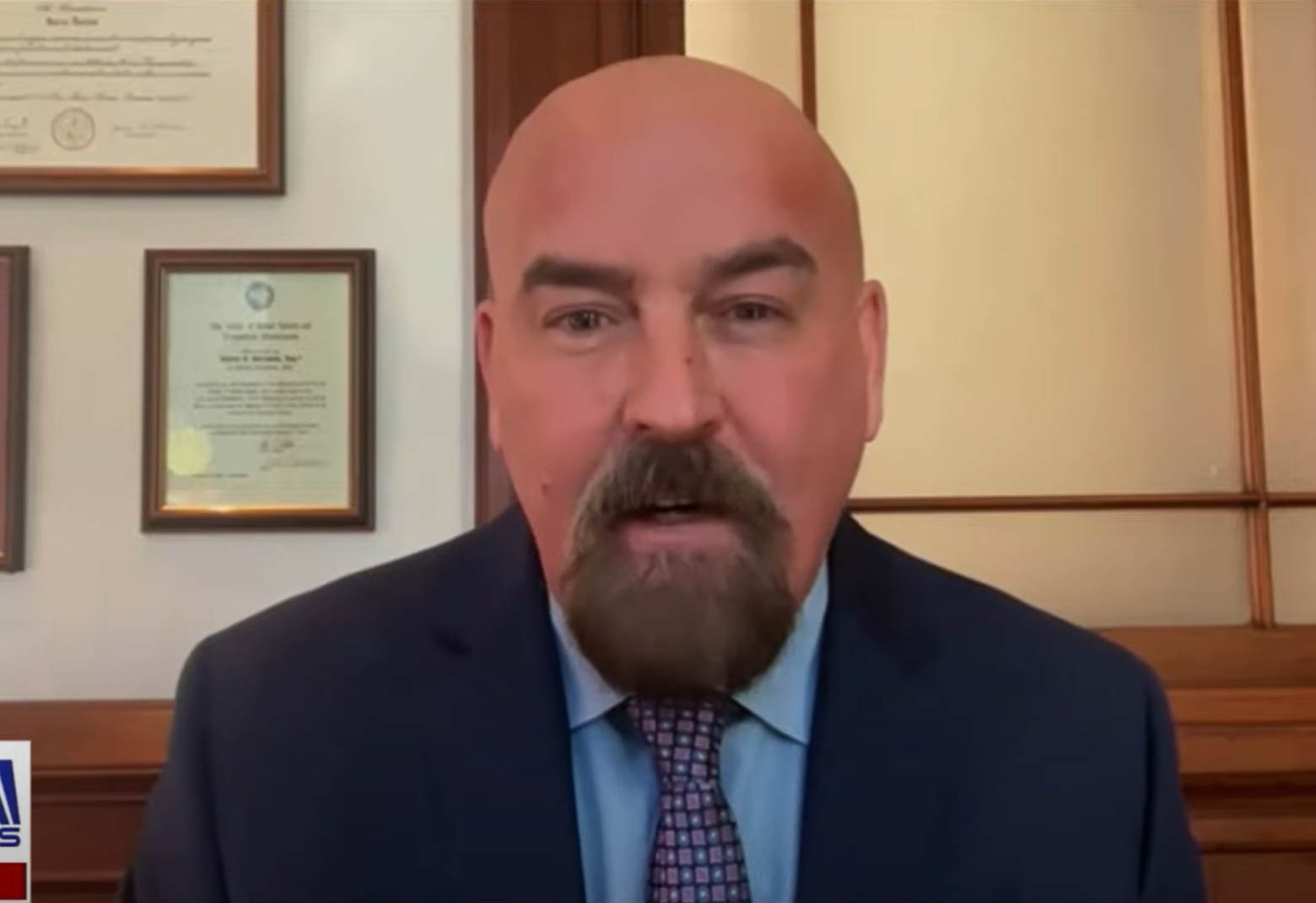

ProXRP Attorney Deaton Highlights New Evidence For Corruption At SEC

Xrp News

Xrp Price Usd