Comprehensive Guide To Listerhill Checking Account: Everything You Need To Know

Looking for a reliable checking account that offers flexibility, convenience, and top-notch customer service? The Listerhill Checking Account might just be the perfect fit for your financial needs. Whether you're managing day-to-day expenses or saving for future goals, this account provides a robust solution tailored to meet your requirements.

Listerhill Checking Account is designed to empower individuals and families with seamless banking experiences. With a wide range of features, competitive rates, and personalized support, Listerhill stands out as a trusted financial institution. In this article, we will delve into the intricacies of this account, helping you understand why it could be an excellent choice for your financial journey.

As you explore the benefits of the Listerhill Checking Account, you'll discover how it caters to both personal and business needs. From ease of access to robust security measures, this account offers a comprehensive solution for your financial management. Let's dive deeper into what makes Listerhill a preferred choice for many.

- Heritage Mental Health Clinic

- Midwest Wine Making Supplies

- 30 Inch Tv Vizio

- Bar B Q Meaning

- Kebek 3 Old Orchard Beach Maine

Table of Contents

- Introduction to Listerhill Checking Account

- Key Features of Listerhill Checking Account

- Eligibility Criteria for Listerhill Checking Account

- Benefits of Choosing Listerhill Checking Account

- Fees and Charges

- Security Measures

- Mobile Banking with Listerhill

- Comparison with Other Checking Accounts

- Frequently Asked Questions

- Conclusion and Next Steps

Introduction to Listerhill Checking Account

Understanding Listerhill Financial Services

Listerhill is a well-established financial institution known for its commitment to customer satisfaction and innovative banking solutions. The Listerhill Checking Account is one of their flagship offerings, designed to cater to the diverse needs of their clientele. With a focus on accessibility, convenience, and security, this account provides a solid foundation for managing your finances effectively.

Core Objectives of the Account

The primary objective of the Listerhill Checking Account is to simplify financial management for its users. By offering a variety of features and tools, Listerhill ensures that customers can handle their day-to-day transactions with ease. This account is ideal for individuals who value flexibility and reliability in their banking services.

Some of the core objectives include:

- West Point Military Academy Address Zip Code

- Golden Era San Francisco

- La Copa South Padre Island Reviews

- El Jefe Taqueria Boston

- Lake Travis Hs Football

- Providing seamless transaction capabilities.

- Ensuring top-tier security measures.

- Offering competitive interest rates.

- Enhancing customer experience through personalized support.

Key Features of Listerhill Checking Account

Unlimited Transactions

One of the standout features of the Listerhill Checking Account is the ability to perform unlimited transactions. Whether you're making deposits, withdrawals, or transfers, this account allows you to manage your finances without worrying about transaction limits.

Free Online Banking

Listerhill offers free online banking services, enabling you to monitor your account activities from anywhere at any time. This feature ensures that you have full control over your finances and can make informed decisions based on real-time data.

Competitive Interest Rates

While many checking accounts offer little to no interest, the Listerhill Checking Account provides competitive interest rates, helping you grow your savings over time. This feature is particularly beneficial for those who prefer to keep their funds in a checking account while earning some return on their balance.

Eligibility Criteria for Listerhill Checking Account

To open a Listerhill Checking Account, you need to meet certain eligibility criteria. These requirements are designed to ensure that only qualified individuals can access the account's benefits. Below are the key eligibility factors:

- Must be at least 18 years of age.

- Need to provide valid identification documents.

- Should have a minimum initial deposit, which varies depending on the specific account type.

For more detailed information on eligibility, you can visit the official Listerhill website or contact their customer service team.

Benefits of Choosing Listerhill Checking Account

Enhanced Security

Listerhill prioritizes the security of its customers' funds. With advanced security measures in place, you can rest assured that your money is safe. These measures include two-factor authentication, fraud protection, and regular account monitoring.

Convenience and Accessibility

With a Listerhill Checking Account, you gain access to a wide network of ATMs and branches, making it easy to conduct transactions wherever you are. Additionally, the mobile banking app allows you to manage your account on the go, providing unparalleled convenience.

Customer Support

Listerhill is renowned for its exceptional customer support. Their team is available 24/7 to assist you with any queries or issues you may encounter. This level of support ensures that you always have a helping hand when needed.

Fees and Charges

While the Listerhill Checking Account offers numerous benefits, it's important to be aware of the associated fees and charges. Understanding these costs will help you make an informed decision about whether this account is right for you.

- Monthly maintenance fee: $5 (waived with direct deposit or maintaining a minimum balance).

- Overdraft fees: $30 per transaction (up to three per day).

- ATM fees: $2.50 for out-of-network withdrawals.

For a comprehensive breakdown of all fees, refer to the official Listerhill fee schedule.

Security Measures

Two-Factor Authentication

Listerhill employs two-factor authentication to enhance the security of your account. This process requires you to provide two forms of identification before accessing your account, significantly reducing the risk of unauthorized access.

Fraud Monitoring

The Listerhill Checking Account comes with built-in fraud monitoring services. These services continuously scan your account for suspicious activities and alert you in case of any irregularities, ensuring that your funds remain protected.

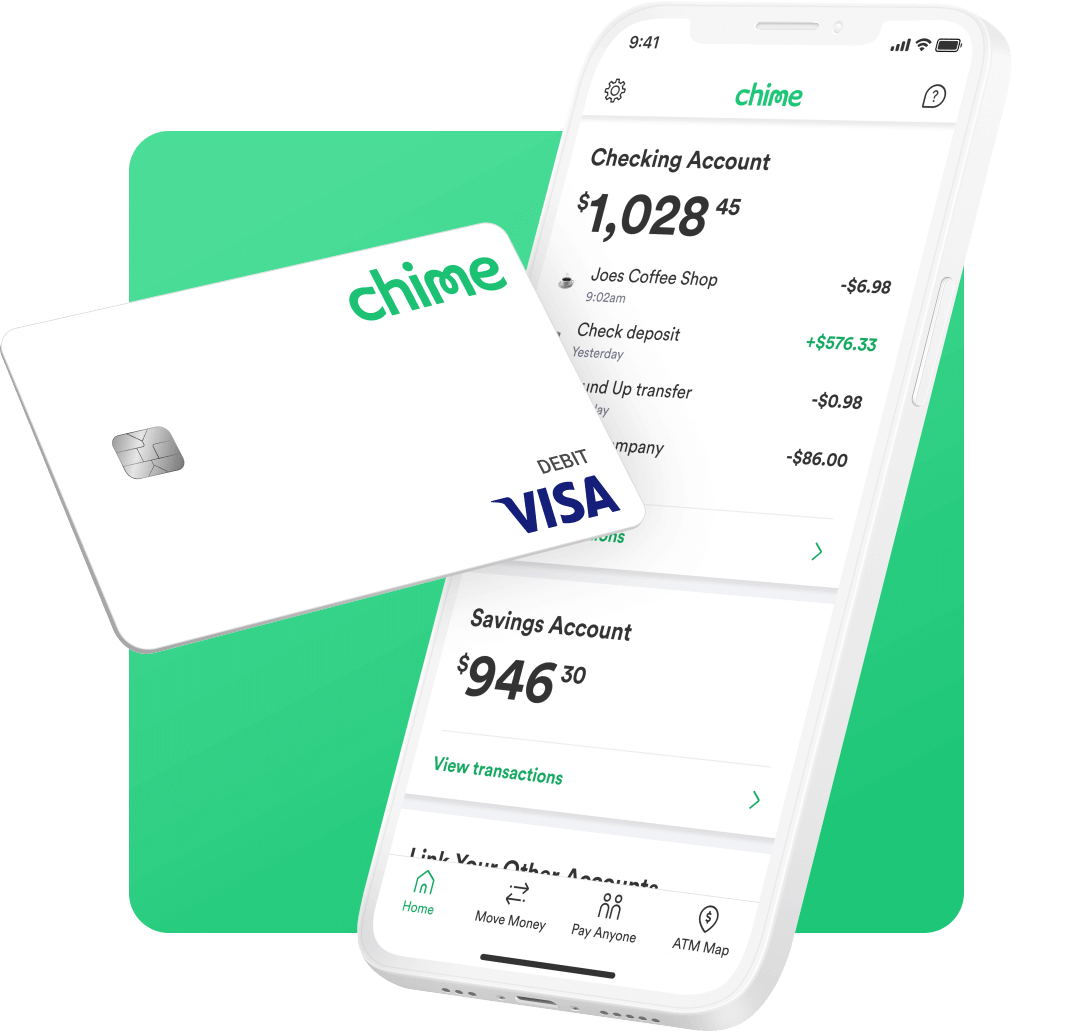

Mobile Banking with Listerhill

Mobile App Features

The Listerhill mobile banking app offers a range of features designed to simplify your banking experience. From checking your balance to transferring funds, you can perform all essential banking tasks with just a few taps on your smartphone.

Push Notifications

Stay informed about your account activities with push notifications. The Listerhill app sends real-time alerts for transactions, account balance updates, and security alerts, keeping you in the loop at all times.

Comparison with Other Checking Accounts

When evaluating the Listerhill Checking Account, it's essential to compare it with other options available in the market. Below is a comparison of key features:

- Interest Rates: Competitive compared to many other checking accounts.

- Security Features: Advanced security measures surpass those offered by most competitors.

- Customer Support: Listerhill's 24/7 support is unmatched by many other financial institutions.

This comparison highlights why the Listerhill Checking Account stands out as a top choice for many customers.

Frequently Asked Questions

Can I open a Listerhill Checking Account online?

Yes, you can open a Listerhill Checking Account online by visiting their official website and following the registration process. The online application is quick and straightforward, requiring only a few basic details and identification documents.

What happens if I exceed the overdraft limit?

If you exceed the overdraft limit, you may incur additional fees. It's crucial to manage your account carefully to avoid unnecessary charges. Listerhill offers overdraft protection services to help prevent such situations.

Is the Listerhill mobile app available for both iOS and Android?

Yes, the Listerhill mobile app is available for both iOS and Android platforms, ensuring that all users can access their accounts conveniently.

Conclusion and Next Steps

In conclusion, the Listerhill Checking Account offers a comprehensive solution for managing your finances effectively. With its wide range of features, competitive interest rates, and robust security measures, it stands out as a reliable choice for both personal and business banking needs.

We encourage you to take the next step by opening a Listerhill Checking Account today. Visit their website or contact their customer service team to learn more about the account and how it can benefit you. Don't forget to share this article with your friends and family, and leave a comment below if you have any questions or feedback.

Thank you for reading, and we hope this guide has provided you with the information you need to make an informed decision about your financial future.

- Rehoboth Beach Delaware County

- Hilton Garden Inn Nashville Smyrna

- Sporting Goods Bozeman Montana

- Train Ride Virginia City Nv

- Dupage Dodge Jeep Chrysler Ram

17 Essential Checking Account Features … Listerhill Credit Union

Can’tMiss Takeaways Of Tips About How To Check My Checking Account

Everyday Checking Account No Minimum… Listerhill Credit Union