Comprehensive Guide To Colonial Penn Life Insurance: Your Trusted Partner For Financial Security

Life insurance is an essential component of financial planning, and Colonial Penn Life Insurance stands out as a reliable provider in the industry. With a strong reputation for delivering affordable coverage options, Colonial Penn has become a go-to choice for individuals seeking peace of mind for their loved ones. Whether you're looking for term life insurance or permanent coverage, understanding the offerings and benefits of Colonial Penn can help you make an informed decision.

Life insurance plays a critical role in safeguarding the future of your family. It provides financial protection during unforeseen circumstances, ensuring that your loved ones are taken care of even in your absence. Colonial Penn Life Insurance has been a trusted name in the insurance sector for decades, offering flexible policies tailored to meet the needs of various individuals and families.

In this article, we will delve into the world of Colonial Penn Life Insurance, exploring its history, product offerings, and benefits. By the end of this guide, you will have a comprehensive understanding of why Colonial Penn is a top choice for life insurance and how it can provide the coverage you need at an affordable price. Let's get started!

- Darlings Auto Bangor Maine

- Houses For Rent Bremerton

- Kebek 3 Old Orchard Beach Maine

- Rehoboth Beach Delaware County

- Glass Stuck In Foot

Table of Contents

- The History of Colonial Penn Life Insurance

- Types of Life Insurance Offered by Colonial Penn

- Benefits of Choosing Colonial Penn Life Insurance

- Coverage Options and Policy Details

- Affordable Pricing and Payment Plans

- Eligibility Requirements and Application Process

- Exceptional Customer Service

- Customer Reviews and Testimonials

- Frequently Asked Questions

- Conclusion: Why Choose Colonial Penn Life Insurance?

The History of Colonial Penn Life Insurance

Colonial Penn Life Insurance has a rich history that dates back to its founding in 1969. Established by the renowned insurance tycoon A.L. Williams, the company quickly gained recognition for its innovative approach to life insurance. Its mission has always been to provide affordable coverage options to individuals and families, ensuring that everyone can access the protection they need.

Over the years, Colonial Penn has expanded its product offerings while maintaining its commitment to affordability and customer satisfaction. The company's dedication to innovation and quality has earned it a strong reputation in the insurance industry. Today, Colonial Penn continues to be a leading provider of life insurance, trusted by millions across the United States.

Key Milestones in Colonial Penn's History

- 1969: Founded by A.L. Williams, introducing a new era of affordable life insurance.

- 1980s: Expansion of product offerings, including term life and permanent insurance options.

- 2000s: Adoption of digital technologies to enhance customer experience.

- Present Day: Continued leadership in the life insurance market, focusing on customer-centric solutions.

Types of Life Insurance Offered by Colonial Penn

Colonial Penn Life Insurance offers a variety of life insurance products to suit different needs and budgets. Understanding the types of policies available can help you choose the best option for your situation.

- Westland Shopping Center Photos

- Avli Little Greek Tavern

- Elle Macpherson How Tall

- El Jefe Taqueria Boston

- South Dakota State Theater

1. Term Life Insurance

Term life insurance provides coverage for a specified period, typically ranging from 10 to 30 years. It is known for its affordability and is ideal for individuals seeking temporary coverage. Colonial Penn's term life policies offer competitive rates and flexible terms, making them an attractive choice for many.

2. Permanent Life Insurance

Permanent life insurance, such as whole life and universal life policies, offers lifelong coverage and builds cash value over time. Colonial Penn's permanent policies provide a combination of protection and savings, making them suitable for long-term financial planning.

Benefits of Choosing Colonial Penn Life Insurance

There are numerous advantages to choosing Colonial Penn Life Insurance for your coverage needs. Below are some key benefits:

- Affordable premiums: Colonial Penn is known for offering competitive rates, making life insurance accessible to everyone.

- Wide range of options: From term life to permanent policies, Colonial Penn caters to diverse customer requirements.

- Quick application process: The company streamlines the application process, allowing customers to secure coverage efficiently.

- Strong financial stability: Colonial Penn is backed by a reputable parent company, ensuring reliability and security.

Coverage Options and Policy Details

Colonial Penn Life Insurance provides a variety of coverage options, allowing customers to customize their policies according to their needs. Whether you require basic coverage or comprehensive protection, Colonial Penn has solutions to fit your lifestyle.

Customizable Policy Features

- Death benefit options: Choose from different coverage amounts to ensure your loved ones are adequately protected.

- Riders and add-ons: Enhance your policy with additional features like accidental death benefits or waiver of premium.

- Convertible term policies: Some term policies can be converted to permanent coverage without a medical exam, offering flexibility for future needs.

Affordable Pricing and Payment Plans

One of the standout features of Colonial Penn Life Insurance is its commitment to affordability. The company offers competitive pricing without compromising on quality or coverage. Additionally, flexible payment plans make it easier for customers to manage their premiums.

Factors Affecting Premium Costs

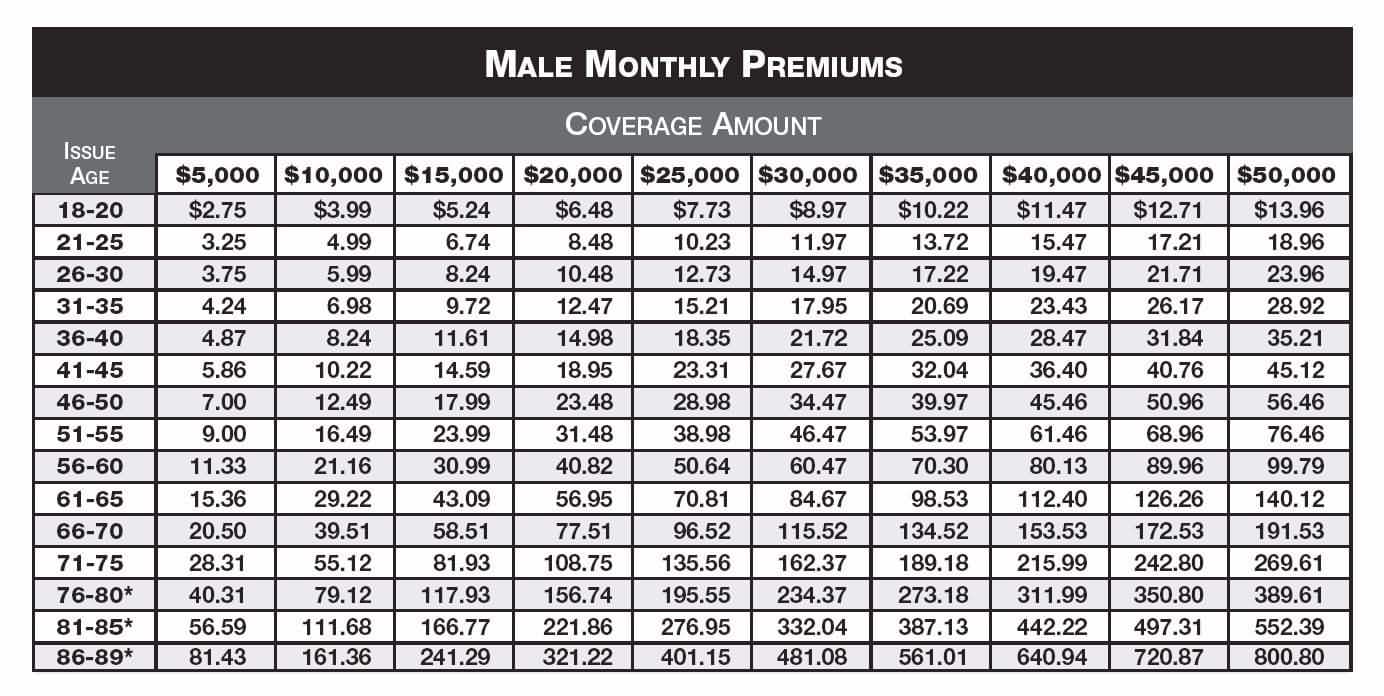

- Age and health: Premiums are influenced by factors such as age, health status, and lifestyle habits.

- Coverage amount: The higher the coverage amount, the higher the premium cost.

- Policy type: Term policies generally have lower premiums compared to permanent policies.

Eligibility Requirements and Application Process

Applying for life insurance with Colonial Penn is a straightforward process. To qualify for coverage, applicants must meet certain eligibility criteria, which typically include age, residency, and health conditions.

Steps to Apply for Colonial Penn Life Insurance

- Complete an online or paper application form.

- Answer health-related questions and provide necessary documentation.

- Participate in a telephonic or in-person medical exam, if required.

- Receive a decision and finalize your policy.

Exceptional Customer Service

Colonial Penn prides itself on delivering exceptional customer service. The company's dedicated team is available to assist customers with any questions or concerns they may have about their policies. From policy management to claims processing, Colonial Penn ensures a smooth and hassle-free experience for its clients.

Ways to Contact Colonial Penn

- Customer service hotline: Reach out to a representative via phone for immediate assistance.

- Online support: Visit the official website for FAQs, chat support, and policy management tools.

- Local agents: Connect with a licensed agent in your area for personalized guidance.

Customer Reviews and Testimonials

Colonial Penn Life Insurance has received positive feedback from satisfied customers. Many appreciate the company's affordability, ease of application, and reliable coverage. Below are some testimonials from real customers:

"I was pleasantly surprised by how affordable Colonial Penn's term life policy was. The application process was quick, and the coverage is exactly what I needed." – Sarah M.

"Colonial Penn has been my go-to for life insurance for over 15 years. Their customer service is top-notch, and I trust them to protect my family's future." – John D.

Frequently Asked Questions

Here are answers to some common questions about Colonial Penn Life Insurance:

Q1: Is Colonial Penn Life Insurance a legitimate company?

Yes, Colonial Penn Life Insurance is a legitimate and reputable company. It is part of the CNO Financial Group, a well-established insurance provider with a strong financial rating.

Q2: How long does it take to get approved for a policy?

The approval process typically takes a few weeks, depending on the complexity of the application and any required medical exams.

Q3: Can I upgrade my term policy to a permanent policy?

Yes, many Colonial Penn term policies can be converted to permanent coverage, subject to certain conditions and without requiring a new medical exam.

Conclusion: Why Choose Colonial Penn Life Insurance?

Colonial Penn Life Insurance offers a comprehensive range of products designed to meet the diverse needs of individuals and families. With its commitment to affordability, reliability, and customer satisfaction, Colonial Penn stands out as a top choice in the life insurance market.

In summary, here are the key reasons to choose Colonial Penn:

- Affordable premiums

- Wide selection of policy options

- Quick and easy application process

- Strong financial backing

- Exceptional customer service

We invite you to explore Colonial Penn's offerings further and take the first step toward securing your family's financial future. Don't forget to leave a comment or share this article with others who may benefit from the information. For more insights on life insurance, check out our other articles on the website.

Data Source: Colonial Penn Official Website

- Why Is Cvs Charging Me 5 A Month

- Words Don T Come Easy Lyrics

- Train Ride Virginia City Nv

- El Jefe Taqueria Boston

- Westland Shopping Center Photos

Colonial Penn Life Insurance Quotes. QuotesGram

Colonial Penn Life Insurance Quote 09 QuotesBae

Colonial Penn Life Insurance Claim Form Colonial Penn Editing Project