Lost Chase Bank Debit Card: A Comprehensive Guide To Handle The Situation

Losing your Chase Bank debit card can be a stressful experience, but knowing how to handle the situation is crucial to protect your finances and personal information. Whether you misplaced your card or suspect it has been stolen, immediate action is necessary to secure your account. This guide will walk you through everything you need to know, from reporting the loss to replacing your card and safeguarding your financial future.

Chase Bank, one of the largest financial institutions in the United States, offers robust services to its customers, including a secure and reliable debit card. However, even with the best security measures in place, accidents can happen. Understanding the steps to take when your Chase Bank debit card is lost ensures that you minimize potential risks and avoid unnecessary stress.

Throughout this article, we’ll explore the best practices for dealing with a lost Chase Bank debit card, including contacting customer service, freezing your account, and preventing fraud. By following the advice in this guide, you’ll be better equipped to handle the situation effectively and regain control of your finances.

- Leaf And Bud Photos

- Where Can I Buy Used Musical Instruments

- What S The Capital Of Monaco

- Animal Hospital In Crystal Lake Il

- It Ends With Us Showtimes Near Viking 3

Table of Contents

- Introduction to Chase Bank Debit Cards

- How to Report a Lost Chase Bank Debit Card

- Steps to Replace Your Chase Bank Debit Card

- Enhancing Security After Losing Your Card

- Preventing Fraud and Protecting Your Account

- Understanding Temporary Chase Bank Debit Cards

- Fees Associated with Replacing a Lost Debit Card

- Lost Chase Bank Debit Card While Traveling

- Tips to Prevent Losing Your Debit Card

- Conclusion and Next Steps

Introduction to Chase Bank Debit Cards

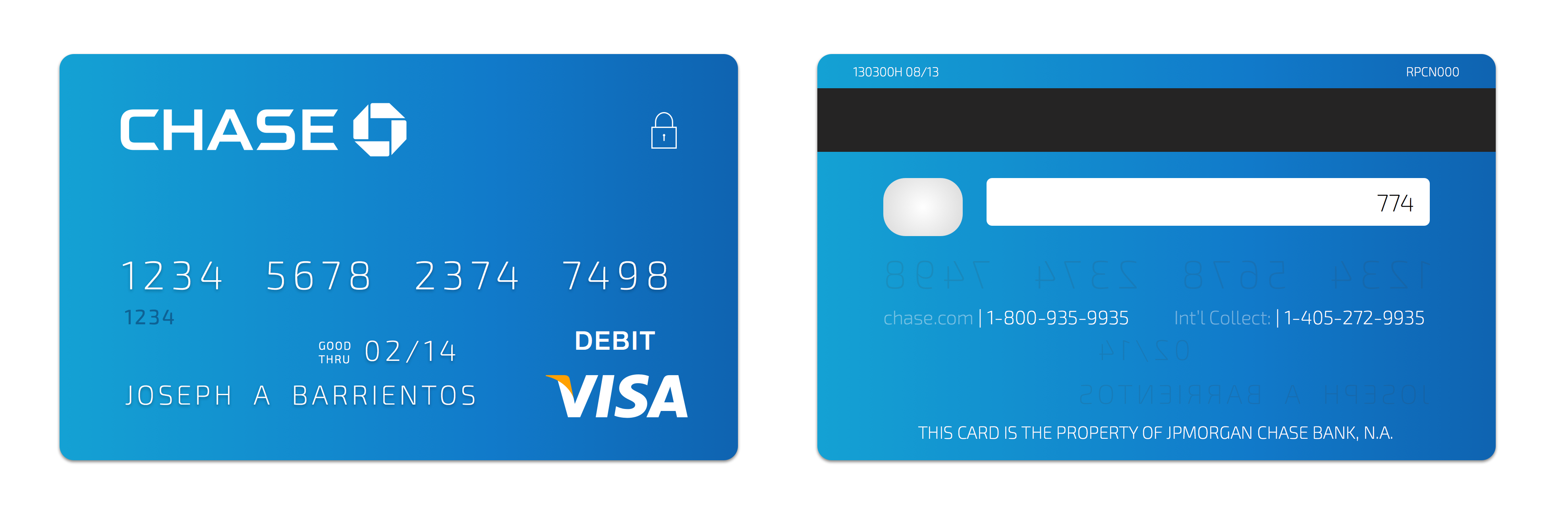

Chase Bank debit cards are designed to provide convenience and security for everyday transactions. These cards allow you to access your account funds directly, making it easy to pay for goods and services both online and in-store. However, with the increasing reliance on digital payments, the importance of safeguarding your debit card cannot be overstated.

A Chase Bank debit card offers numerous benefits, including:

- Global acceptance at millions of merchants

- Zero liability protection against unauthorized transactions

- Convenient access to cash through ATMs worldwide

Despite these advantages, losing your Chase Bank debit card can pose significant risks. In the following sections, we’ll delve into the steps you should take if this happens to you.

- Rehoboth Beach Delaware County

- What Is King Harris Real Name

- What Does Aces Tattoo Stand For

- Who Is Moriah Plath S Ex Boyfriend

- Family Care Eye Center

How to Report a Lost Chase Bank Debit Card

Once you realize your Chase Bank debit card is missing, it’s essential to act quickly. The sooner you report the loss, the less likely you are to experience fraudulent transactions. Here’s how you can report a lost Chase Bank debit card:

Contacting Chase Customer Service

Chase Bank provides multiple channels for customers to report a lost card. You can:

- Call the customer service number listed on your account statements or the Chase website

- Use the Chase Mobile app to report the loss

- Visit a local Chase branch for assistance

Each method is designed to ensure your account remains secure while you await a replacement card.

Steps to Replace Your Chase Bank Debit Card

After reporting your lost Chase Bank debit card, the next step is to request a replacement. The process is straightforward and can be initiated through the same channels used to report the loss.

Requesting a New Card

When requesting a replacement card, you may need to provide some personal information to verify your identity. This includes:

- Your full name

- Social Security number

- Date of birth

Once your identity is confirmed, Chase will issue a new debit card and send it to your registered address. The delivery time typically ranges from 7 to 10 business days, depending on your location.

Enhancing Security After Losing Your Card

Losing your Chase Bank debit card is a wake-up call to enhance your financial security. Implementing additional security measures can help protect your account from future incidents.

Freezing Your Account

If you suspect fraudulent activity, consider freezing your account temporarily. This prevents unauthorized transactions until you receive your replacement card. To freeze your account, contact Chase customer service and follow their instructions.

Additionally, enabling two-factor authentication (2FA) for your Chase account adds an extra layer of security. This ensures that even if someone gains access to your login credentials, they won’t be able to access your account without the second verification step.

Preventing Fraud and Protecting Your Account

Fraudulent activity is a real concern when your Chase Bank debit card is lost. Fortunately, Chase offers robust fraud protection to keep your account safe.

Monitoring Your Account

Regularly monitoring your Chase account is one of the best ways to detect and prevent fraud. Set up transaction alerts through the Chase Mobile app or online banking to receive notifications for every purchase made with your card. This allows you to quickly identify and dispute any unauthorized transactions.

According to a JPMorgan Chase report, the bank processed over $3 trillion in payments in 2022, emphasizing the importance of vigilant fraud prevention measures.

Understanding Temporary Chase Bank Debit Cards

In some cases, Chase may issue a temporary debit card while you wait for your permanent replacement. These cards are fully functional and can be used for transactions until your new card arrives.

Using a Temporary Card

Temporary Chase Bank debit cards come with unique card numbers and expiration dates. While they offer the same functionality as your original card, they may have some limitations, such as restricted international use. Be sure to check with Chase customer service for specific details about your temporary card.

Fees Associated with Replacing a Lost Debit Card

Replacing a lost Chase Bank debit card usually comes at no cost to the customer. However, certain circumstances may incur fees. For example, expedited delivery of a replacement card may require an additional charge.

Avoiding Unexpected Fees

To avoid unexpected fees, it’s important to understand Chase’s fee structure. Review your account agreement or contact customer service for clarity on any potential costs associated with replacing your lost debit card.

Lost Chase Bank Debit Card While Traveling

Losing your Chase Bank debit card while traveling can be particularly inconvenient. However, Chase offers resources to assist customers in such situations.

Travel Assistance Services

Chase provides 24/7 travel assistance services to help customers replace lost cards while abroad. Simply contact Chase customer service and provide your location details to expedite the process. In some cases, Chase may arrange for a replacement card to be delivered to your current location.

Tips to Prevent Losing Your Debit Card

Prevention is always better than cure. Here are some tips to help you avoid losing your Chase Bank debit card:

- Keep your card in a secure wallet or purse

- Regularly check your card’s location after use

- Use digital wallet services like Chase Pay to reduce reliance on physical cards

By implementing these simple practices, you can significantly reduce the risk of losing your debit card.

Conclusion and Next Steps

Losing your Chase Bank debit card can be unsettling, but with the right knowledge and tools, you can handle the situation effectively. From reporting the loss to replacing your card and enhancing security, this guide has provided comprehensive advice to protect your finances and personal information.

We encourage you to take action by:

- Reviewing your Chase account for any suspicious activity

- Enabling two-factor authentication for added security

- Sharing this article with friends and family to help them prepare for similar situations

Stay vigilant and proactive in safeguarding your financial well-being. For more valuable insights and resources, explore our other articles on personal finance and banking solutions.

- Where To Get A Husky Dog

- Where Is The Legacy Museum

- Woodinville Department Of Licensing

- Calgary Stampede Calgary Canada

- What Age Do Kittens Drink Water

Chase Debit Milo Kowalski

Chase Bank Debit Card Designs

Chase Bank Debit Card Designs 2024 Nona Thalia