Zelle And Regions Bank: A Comprehensive Guide To Seamless Banking

Regions Bank has embraced digital innovation by offering Zelle as part of its services, enhancing customer convenience and security. In today's fast-paced world, financial institutions are increasingly adopting modern payment solutions to meet evolving customer needs. Zelle, a leading peer-to-peer payment platform, has become an integral part of Regions Bank's offerings, empowering users to send and receive money instantly. Whether you're transferring funds to family members or splitting bills with friends, Zelle provides a seamless and secure experience.

For Regions Bank customers, integrating Zelle into their banking routine offers numerous advantages. Not only does it streamline transactions, but it also ensures that money transfers occur within the same banking ecosystem, reducing risks associated with third-party applications. This guide explores the features, benefits, and practical applications of Zelle through Regions Bank, ensuring you have all the information needed to make informed financial decisions.

As technology continues to reshape the banking landscape, understanding how Zelle operates within Regions Bank's framework is essential. This article delves into the intricacies of this partnership, providing actionable insights for both existing and prospective customers. By the end of this guide, you'll have a comprehensive understanding of how Zelle enhances your banking experience with Regions Bank.

- Crunch Fitness Fern Creek

- South Dakota State Theater

- Glass Stuck In Foot

- What Cancer Did Gabe Solis Died From

- How To Kill A Unicorn Movie

Table of Contents

- Introduction to Zelle

- Regions Bank Overview

- Zelle Integration with Regions Bank

- Benefits of Using Zelle with Regions Bank

- How to Use Zelle Through Regions Bank

- Security Features of Zelle

- Limitations and Challenges

- Comparison with Other Payment Methods

- Tips for Effective Use

- Future of Zelle and Regions Bank

Introduction to Zelle

Zelle is a digital payment service that enables users to send and receive money directly from one bank account to another within the United States. Unlike other peer-to-peer platforms, Zelle operates through participating financial institutions, including Regions Bank, ensuring a secure and efficient transfer process. According to a 2022 report by Zelle, over 38 million active users rely on the platform for their financial transactions, highlighting its growing popularity.

How Zelle Works

When you use Zelle through Regions Bank, the process is straightforward. After enrolling in the service, you can send money to anyone with a U.S. bank account by simply entering their email address or mobile number. The funds are typically transferred within minutes, making it one of the fastest payment solutions available. Additionally, Zelle does not charge any fees for transactions, making it cost-effective for users.

Key Features of Zelle

- Instant transfers between enrolled users

- No transaction fees

- Direct integration with bank accounts

- High security standards

- Wide network of participating banks

Regions Bank Overview

Regions Bank, headquartered in Birmingham, Alabama, is one of the largest full-service banks in the United States. With over 1,300 branches and 2,400 ATMs, Regions Bank serves millions of customers across 16 states. The bank has consistently prioritized innovation, offering a range of digital banking solutions to enhance customer convenience. By integrating Zelle into its services, Regions Bank further solidifies its commitment to providing modern banking experiences.

- Doubletree Hotel International Drive Orlando Fl

- What Does Aces Tattoo Stand For

- Earls Funeral Home Barbados

- Rush Hour Go Karts Garner

- What S The Capital Of Monaco

Regions Bank's Digital Transformation

In recent years, Regions Bank has invested heavily in digital technologies to improve customer satisfaction. This includes launching mobile banking apps, online bill pay services, and partnerships with leading fintech platforms like Zelle. According to a 2023 Regions Bank report, over 60% of its customers actively use digital banking services, underscoring the growing demand for convenient and secure financial solutions.

Zelle Integration with Regions Bank

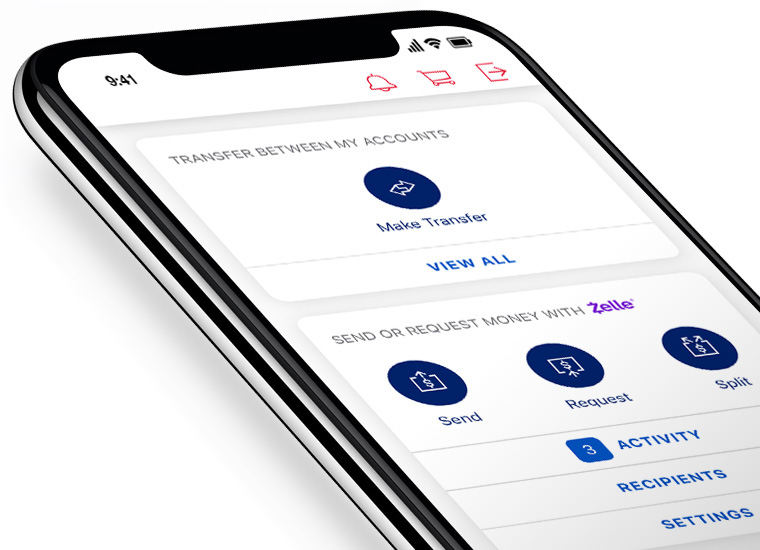

The integration of Zelle with Regions Bank represents a significant milestone in the evolution of digital banking. By incorporating Zelle into its mobile app and online banking platform, Regions Bank empowers customers to perform peer-to-peer transactions effortlessly. This partnership not only enhances user experience but also strengthens the bank's position in the competitive financial services market.

Steps to Enroll in Zelle Through Regions Bank

To start using Zelle with Regions Bank, follow these simple steps:

- Log in to your Regions Bank online account or mobile app

- Select the "Send Money with Zelle" option

- Enter your email address or mobile number

- Verify your enrollment details

- Begin sending and receiving money instantly

Benefits of Using Zelle with Regions Bank

Using Zelle through Regions Bank offers several advantages that cater to modern banking needs. These benefits include speed, security, convenience, and cost-effectiveness, making Zelle an ideal choice for various financial transactions.

Speed and Efficiency

One of the standout features of Zelle is its ability to transfer funds almost instantly. Unlike traditional bank transfers that may take several business days, Zelle ensures that money reaches the recipient's account within minutes. This rapid processing time is particularly beneficial for urgent transactions or last-minute payments.

Enhanced Security

Security is a top priority for Zelle and Regions Bank. The platform employs advanced encryption technologies and two-factor authentication to protect user data and prevent unauthorized access. Additionally, since Zelle operates directly through bank accounts, it eliminates the need for intermediaries, reducing the risk of fraud.

How to Use Zelle Through Regions Bank

Once you've enrolled in Zelle through Regions Bank, using the service becomes intuitive. Whether you're sending money to a friend or receiving funds from a family member, the process remains consistent and user-friendly.

Steps to Send Money

- Log in to your Regions Bank mobile app

- Select the "Zelle" option

- Enter the recipient's email address or mobile number

- Specify the amount to send

- Confirm the transaction

Steps to Receive Money

- Ensure your email address or mobile number is registered with Zelle

- When someone sends you money, you'll receive a notification

- Log in to your Regions Bank account to access the funds

Security Features of Zelle

Security is paramount when it comes to financial transactions, and Zelle excels in this area. The platform employs multiple layers of protection to safeguard user information and ensure secure transactions.

Encryption Technology

Zelle uses industry-leading encryption protocols to protect sensitive data during transmission. This ensures that all communications between users and the platform remain confidential and secure.

Two-Factor Authentication

To prevent unauthorized access, Zelle requires two-factor authentication for certain actions. This additional layer of security helps verify user identities and reduces the risk of fraudulent activities.

Limitations and Challenges

While Zelle offers numerous benefits, it is not without limitations. Understanding these challenges can help users make informed decisions about when and how to use the service.

Transaction Limits

Zelle imposes daily and monthly transaction limits to protect users from potential fraud. For Regions Bank customers, the maximum amount that can be sent in a single day is $500, with a monthly limit of $2,000. These restrictions may pose challenges for users requiring larger transfers.

Recipient Requirements

For a transaction to be successful, the recipient must have a U.S. bank account and be enrolled in Zelle. If the recipient is not yet enrolled, they will receive an invitation to join, which may delay the transfer process.

Comparison with Other Payment Methods

When evaluating peer-to-peer payment platforms, it's essential to compare Zelle with other popular options like Venmo, PayPal, and Cash App. Each platform has its unique features and limitations, making it crucial to choose the one that best fits your needs.

Zelle vs. Venmo

While both Zelle and Venmo facilitate peer-to-peer payments, they differ in several key areas. Zelle offers instant transfers and no transaction fees, but it lacks social features like Venmo. Additionally, Venmo allows users to fund transactions from their balance, credit cards, or linked bank accounts, providing more flexibility.

Tips for Effective Use

To maximize the benefits of using Zelle through Regions Bank, consider the following tips:

- Ensure your contact information is up-to-date

- Regularly monitor your transaction history

- Set up notifications for incoming and outgoing payments

- Review transaction limits to avoid potential delays

Future of Zelle and Regions Bank

The partnership between Zelle and Regions Bank is expected to grow stronger in the coming years. As technology continues to evolve, both organizations are committed to enhancing their services to meet customer demands. This includes exploring new features, improving user interfaces, and expanding the network of participating banks.

According to a 2023 Zelle press release, the platform aims to introduce additional functionalities, such as bill payments and international transfers. These developments could further solidify Zelle's position as a leading payment solution and strengthen its collaboration with Regions Bank.

Conclusion

Zelle and Regions Bank have revolutionized the way customers handle financial transactions by offering a seamless, secure, and cost-effective peer-to-peer payment solution. By understanding the features, benefits, and limitations of Zelle, users can make informed decisions about incorporating it into their banking routines. Whether you're sending money to loved ones or splitting expenses with friends, Zelle provides a reliable and efficient option.

We encourage you to share your thoughts and experiences with Zelle through Regions Bank in the comments section below. Additionally, feel free to explore other articles on our website for more insights into digital banking solutions. Together, let's embrace the future of finance and unlock new possibilities for managing our money!

- Where Is The Legacy Museum

- Universal Studios Hollywood Whoville

- Kebek 3 Old Orchard Beach Maine

- Little House On The Prairie Mary Blind

- Las Vegas Hotel Mgm Grand Pictures

How To Delete Zelle Recipient From Regions Bank NetworkBuildz

Zelle® Send & Receive Money Online or with Bank of America Mobile App

Order statement Regions bank Instant Delivery Custom info